SAS AML : Advanced Monitoring for Fraud Detection & Prevention

SAS AML: in summary

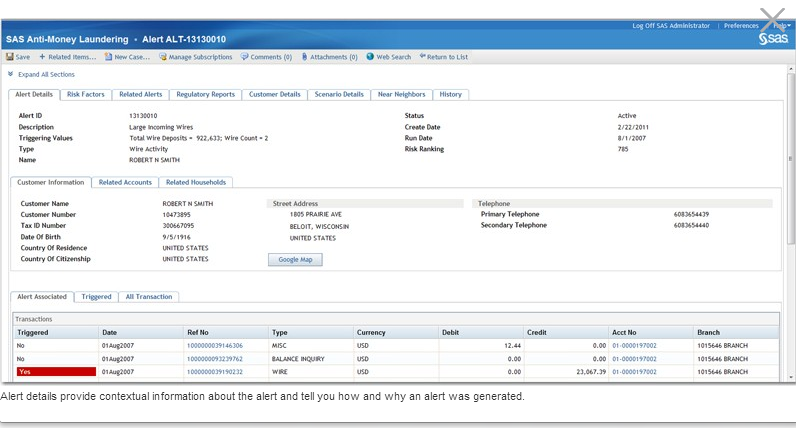

SAS AML caters to financial institutions by revolutionising fraud detection and compliance management. Designed to streamline operations, it offers dynamic monitoring capabilities and robust data analysis, setting itself apart with advanced pattern recognition and a user-friendly risk management system.

What are the main features of SAS AML?

Enhanced Fraud Detection

SAS AML focuses on enhanced fraud detection that leverages advanced analytics and machine learning to identify suspicious activities. This is crucial for financial institutions to mitigate fraud risks effectively.

- Real-time transaction monitoring

- Advanced pattern recognition

- Automated anomaly detection

Comprehensive Risk Management

With an emphasis on comprehensive risk management, the software provides a scalable and adaptable framework to assess various risk factors, ensuring compliance with diverse regulatory requirements.

- Dynamic risk scoring

- Customisable rule sets

- Integration with external data sources

Efficient Compliance Processes

Optimise your compliance operations with SAS AML’s efficient compliance processes. It streamlines the workflow to maintain regulatory adherence while reducing operational costs.

- Automated reporting and documentation

- Flexible audit trails

- Multi-jurisdictional compliance checks

Its benefits

Provided by SCC

SAS AML: its rates

Standard

Rate

On demand

Clients alternatives to SAS AML

Robust anti-money laundering software features real-time transaction monitoring, advanced risk assessment tools, and comprehensive reporting capabilities.

See more details See less details

AP Scan is a powerful solution designed for effective anti-money laundering efforts. It offers real-time transaction monitoring to detect suspicious activities immediately. The software includes advanced risk assessment tools that help organisations identify vulnerable areas within their operations, ensuring compliance with regulatory standards. Additionally, it features comprehensive reporting capabilities, streamlining the process of documenting and submitting necessary reports to authorities.

Read our analysis about AP ScanTo AP Scan product page

Comprehensive anti-money laundering solution featuring real-time risk assessment, automated customer due diligence, and regulatory compliance tools.

See more details See less details

This anti-money laundering software offers a robust set of features designed for effective risk management. Key functionalities include real-time risk assessment to identify potential threats, automated customer due diligence that streamlines onboarding processes, and tools for ensuring compliance with evolving regulations. Its user-friendly interface facilitates seamless integration into existing workflows, making it an ideal choice for businesses seeking to enhance their AML strategies.

Read our analysis about OndatoTo Ondato product page

This software offers robust reporting tools, real-time transaction monitoring, and compliance checks to effectively combat money laundering activities.

See more details See less details

Whistleblower Software provides an integrated suite of features designed to enhance anti-money laundering efforts. With advanced reporting tools, users can generate detailed insights into financial activities. Real-time transaction monitoring helps identify suspicious patterns instantly, while compliance checks ensure adherence to regulatory standards. This comprehensive approach empowers organisations to detect and prevent money laundering effectively, making it an invaluable asset for risk management and compliance teams.

Read our analysis about Whistleblower SoftwareTo Whistleblower Software product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.