Swile : Revolutionise Employee Benefits with Innovative Solutions

Swile: in summary

Swile is designed to transform employee benefits, targeting businesses of all sizes. Offering digital meal vouchers, team engagement tools, and advanced expense management, it sets itself apart by blending convenience, integration, and a user-friendly approach.

What are the main features of Swile?

Streamlined Meal Vouchers

Swile innovates the traditional meal voucher experience by digitising the process, enhancing accessibility and ease of use. Businesses and employees alike benefit from the flexibility and efficiency Swile offers, providing a seamless solution for everyday meal expenses.

- Digital Vouchers: Easily accessible via mobile app, simplifying usage and management.

- Integration with Payment Systems: Compatible with most payment terminals, ensuring widespread acceptance.

- Real-time Balance Monitoring: Helps users keep track of their funds instantaneously.

Team Engagement Tools

Beyond financial perks, Swile focuses on employee engagement, fostering a vibrant workplace community. It offers tools that encourage interaction, making team cohesion and satisfaction a strategic priority for companies.

- Customisable Surveys: Gather valuable feedback to enhance work culture and processes.

- Event Organisation: Streamline planning and participation for corporate events and celebrations.

- Recognition Systems: Integrated features that commend outstanding contributions and milestones.

Advanced Expense Management

Managing expenses is made effortless with Swile's intuitive tools. Its advanced features ensure accurate reporting and reimbursement, alleviating administrative burdens and enhancing financial clarity within the organisation.

- Automated Receipt Capture: Converts physical receipts into digital entries, simplifying record-keeping.

- Detailed Spending Reports: Gain insights into spending trends for better fiscal management.

- Multi-currency Support: Ideal for global operations, accommodating diverse financial transactions.

Its benefits

GDPR

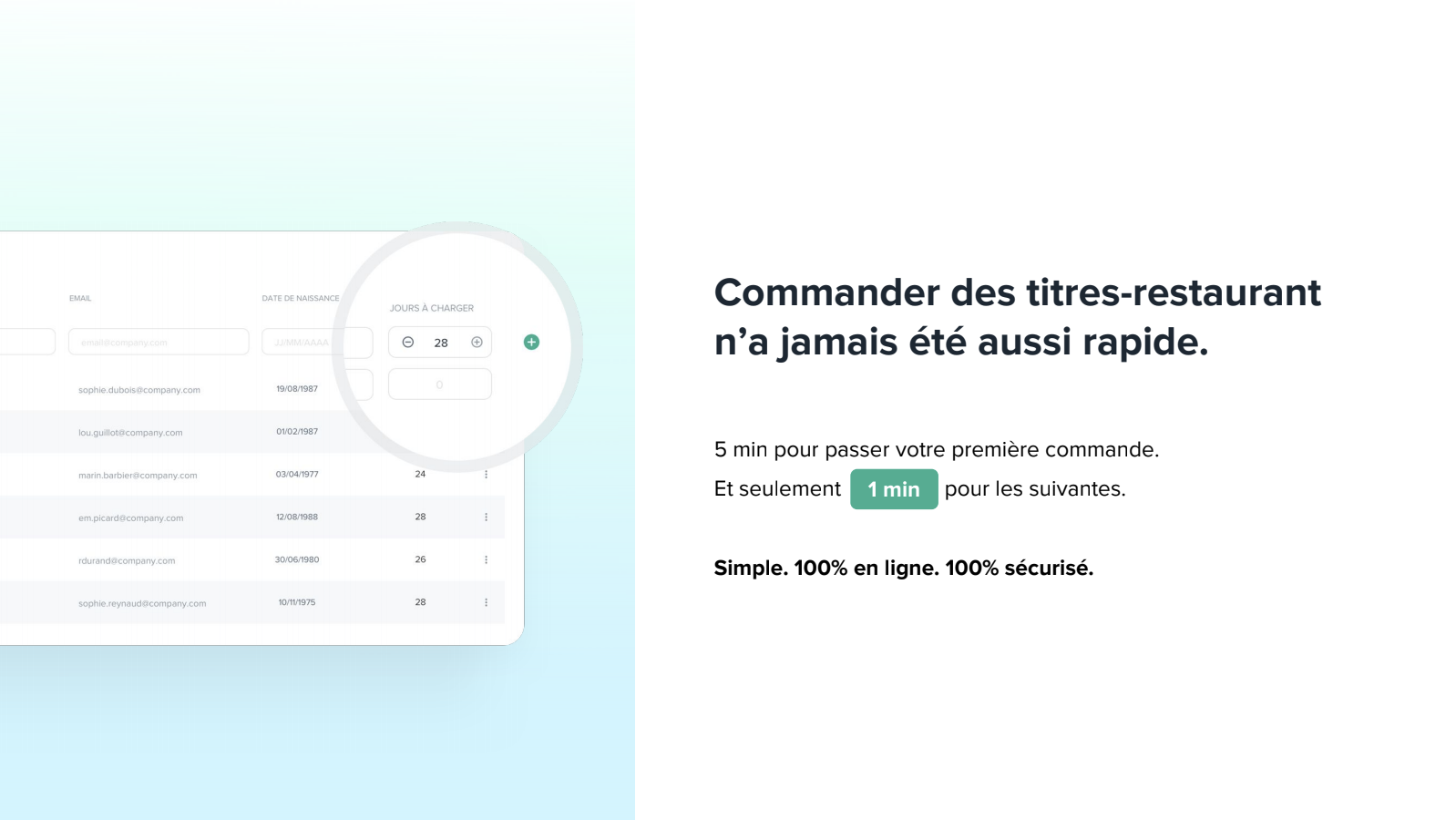

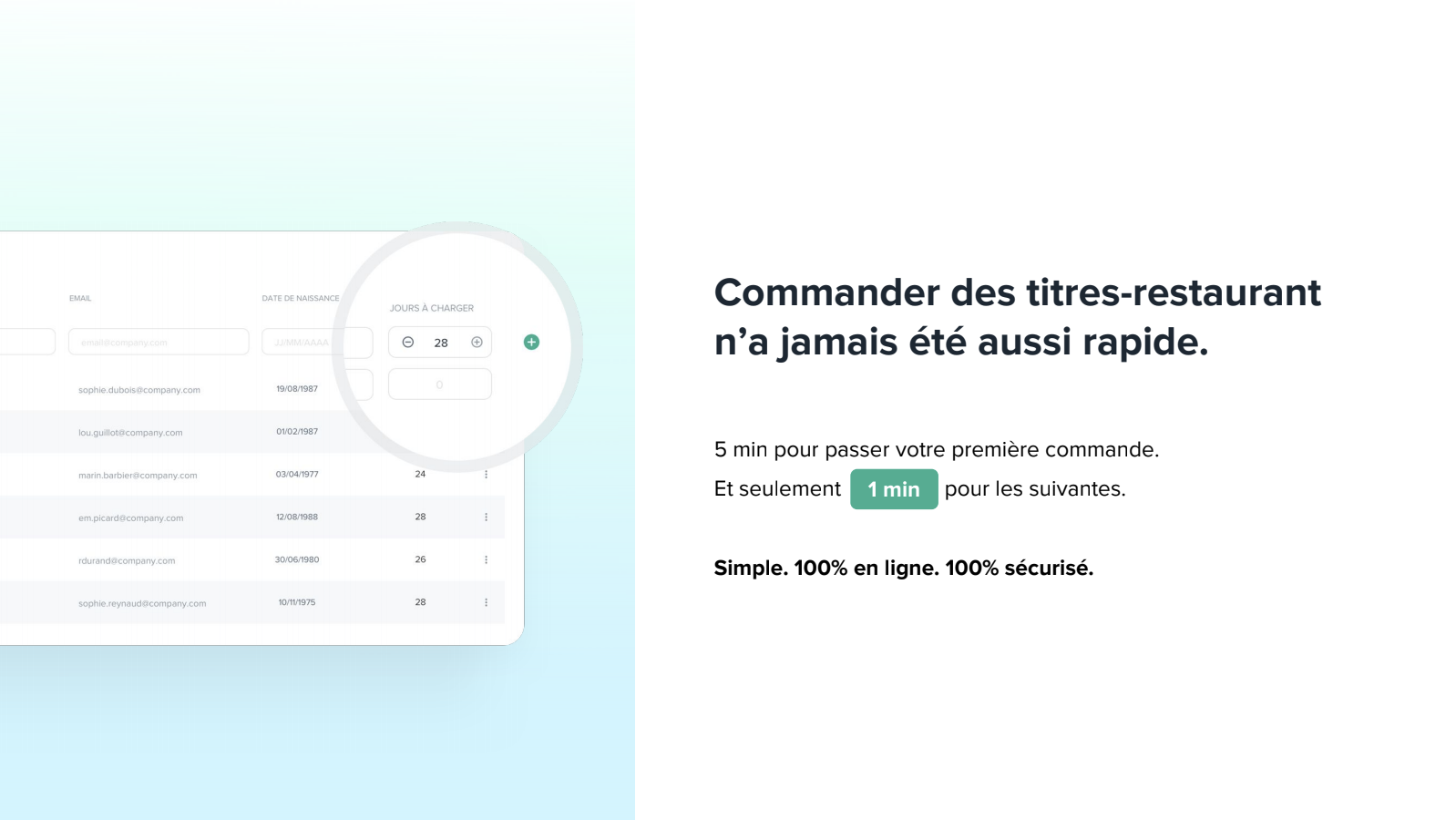

Swile - Screenshot 1

Swile - Screenshot 1  Swile - Screenshot 2

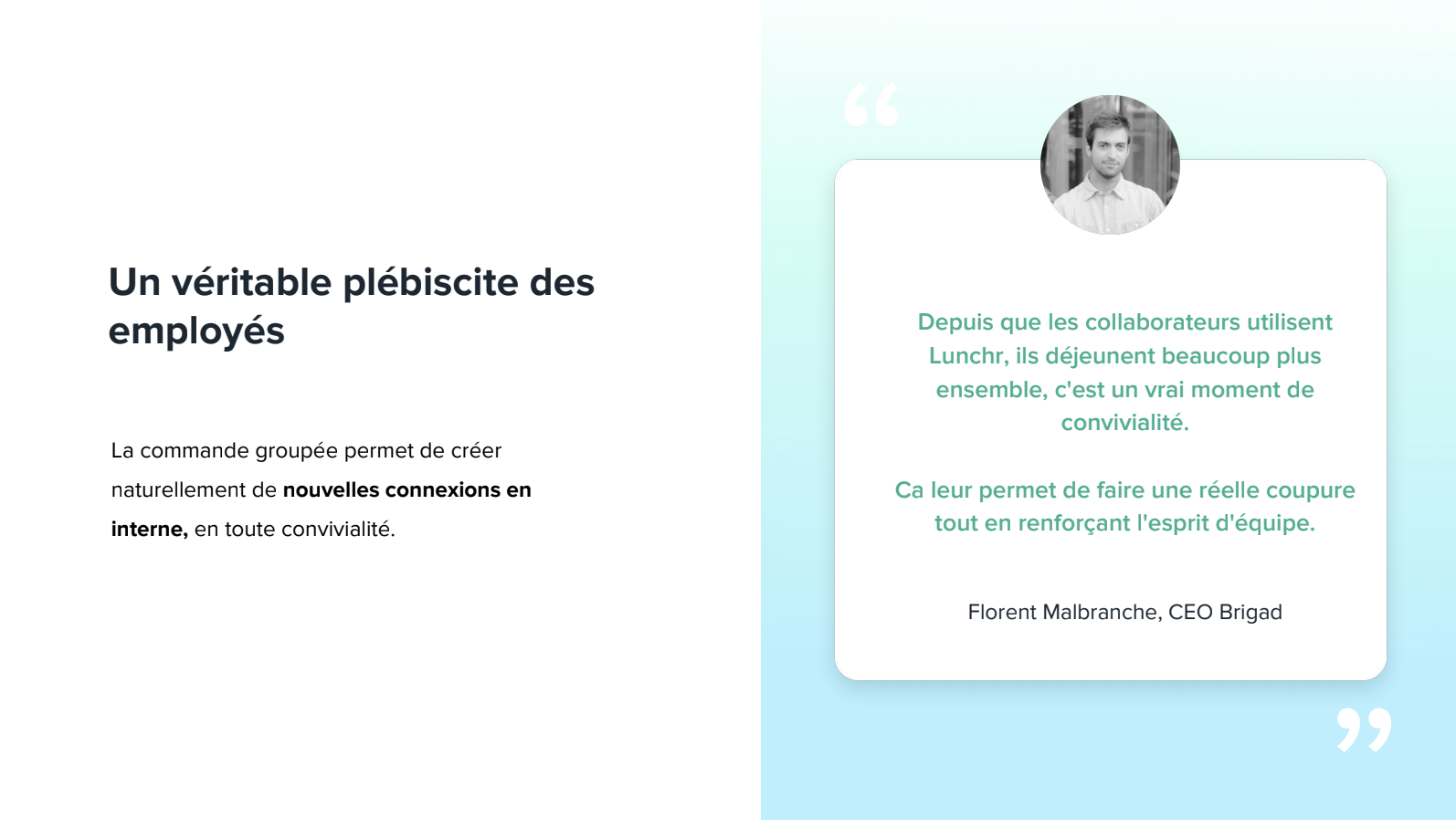

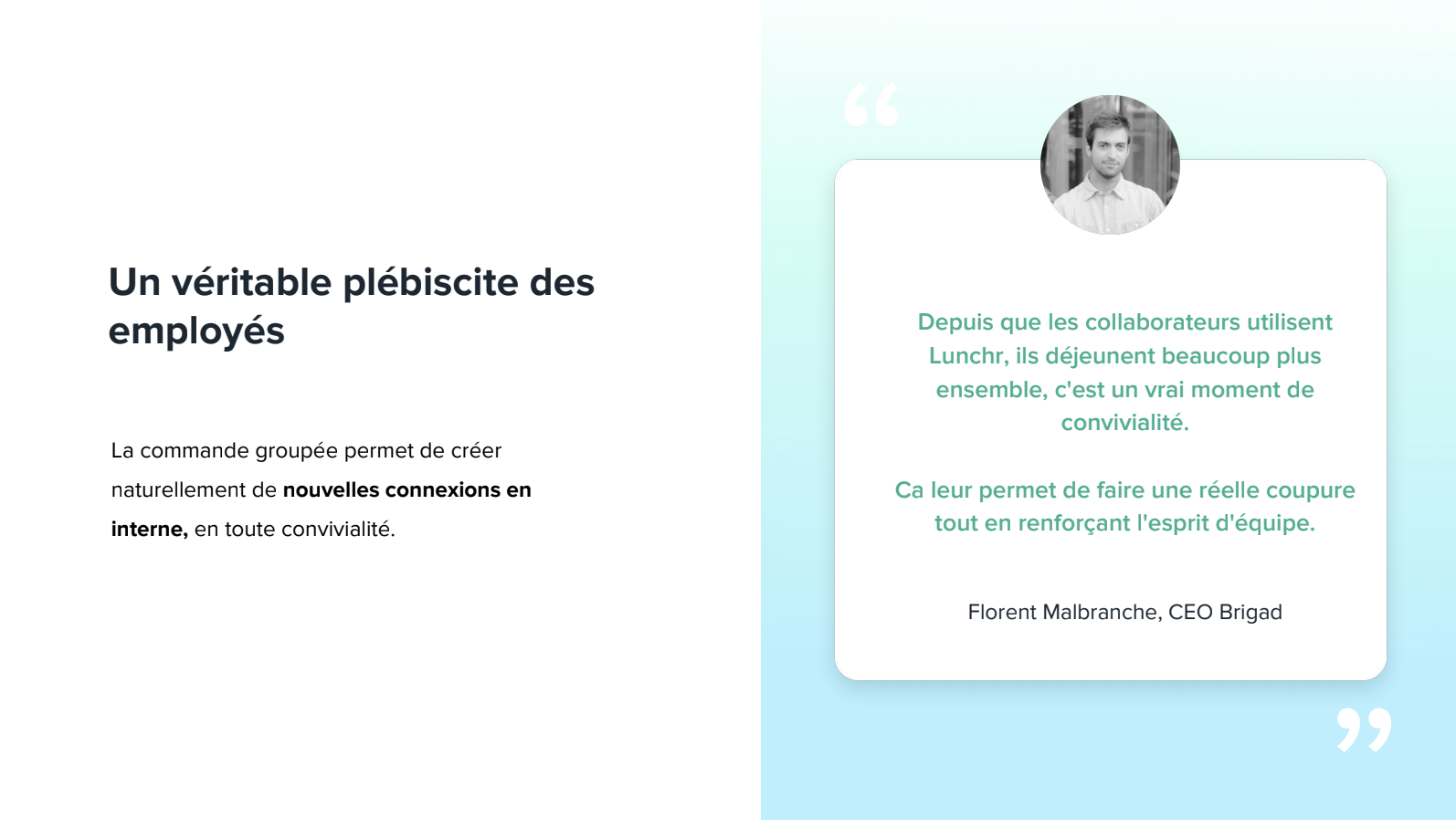

Swile - Screenshot 2  Swile - Screenshot 3

Swile - Screenshot 3

Swile: its rates

Standard

Rate

On demand

Clients alternatives to Swile

Streamline expense management with automated processes, real-time tracking, and simplified reporting.

See more details See less details

With N2F, users can easily capture receipts, categorize expenses, and submit reports from anywhere. The software's powerful integrations with accounting systems and credit cards ensure accurate and efficient expense tracking. Plus, its user-friendly interface and mobile app make it easy for employees to stay on top of their expenses while on the go.

Read our analysis about N2FBenefits of N2F

User-friendly, time-saving solution with smart scan (OCR)

Legal archiving: discard all paper receipts

Mobile and Web app designed for SMEs and MidCaps

To N2F product page

Create and share customised digital business cards effortlessly, manage contacts seamlessly, and analyse engagement metrics to maximise networking opportunities.

See more details See less details

This software offers users the ability to design and distribute personalised digital business cards with ease, ensuring a professional touch in networking situations. Features include seamless contact management to keep information organised and an analytics function that enables users to track engagement rates of their cards. This comprehensive approach not only enhances visibility but also helps in refining networking strategies based on real-time data insights.

Read our analysis about TideTo Tide product page

Streamlined payment processing, user-friendly interface, and secure transactions make this business card software ideal for managing payments efficiently.

See more details See less details

Takepayments offers a streamlined payment processing solution that enhances efficiency for businesses. Its user-friendly interface ensures easy navigation, while the software prioritises secure transactions to protect sensitive customer information. With features designed to simplify payment management, it caters perfectly to businesses seeking a reliable way to handle monetary transactions seamlessly. Ideal for both small enterprises and larger organisations, it aims to optimise cash flow and improve customer experiences.

Read our analysis about takepaymentsTo takepayments product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.