VisionCredit Fintech : Innovative Lending and Credit Management Software

VisionCredit Fintech: in summary

VisionCredit Fintech revolutionises lending with advanced analytics and seamless integrations for financial institutions. This cutting-edge software is designed for banks, credit unions, and other financial entities to efficiently manage credit processes with features like automated risk assessment and customisable dashboards.

What are the main features of VisionCredit Fintech?

Automated Risk Assessment

Streamline your credit evaluation process with VisionCredit's automated risk assessment feature. Utilising AI technology and real-time analytics, it offers precise credit risk insights, reducing errors and enhancing decision-making efficiency.

- AI-driven credit scoring

- Real-time data analysis

- Predictive modelling capabilities

Customisable Dashboards

Gain a comprehensive overview of your lending operations with customisable dashboards that provide insights and statistics tailored to your needs. The flexibility allows users to focus on critical metrics and streamline workflow.

- Intuitive drag-and-drop interface

- Integration with existing data sources

- Real-time updates and alerts

Integrated Loan Processing

Enhance your lending strategy with VisionCredit's integrated loan processing feature. This all-in-one system manages the entire loan lifecycle efficiently, from origination to repayment, saving time and resources.

- End-to-end loan management

- Seamless application tracking

- Automated documentation and compliance checks

Its benefits

GDPR

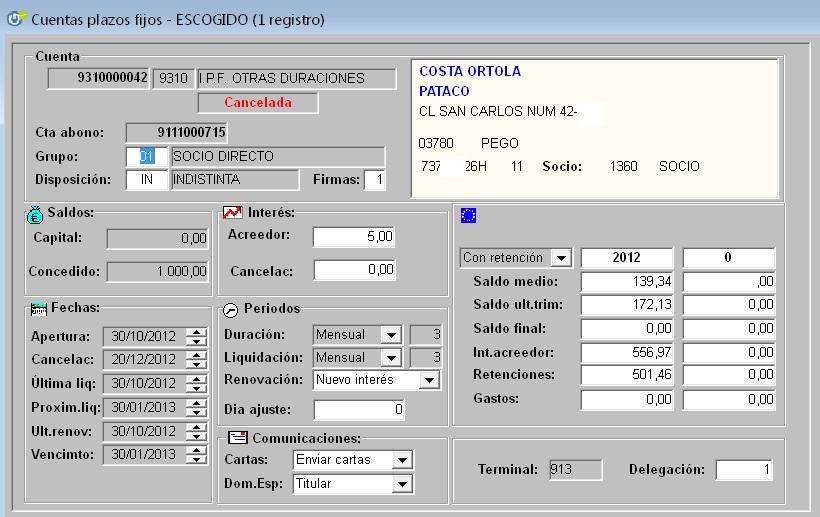

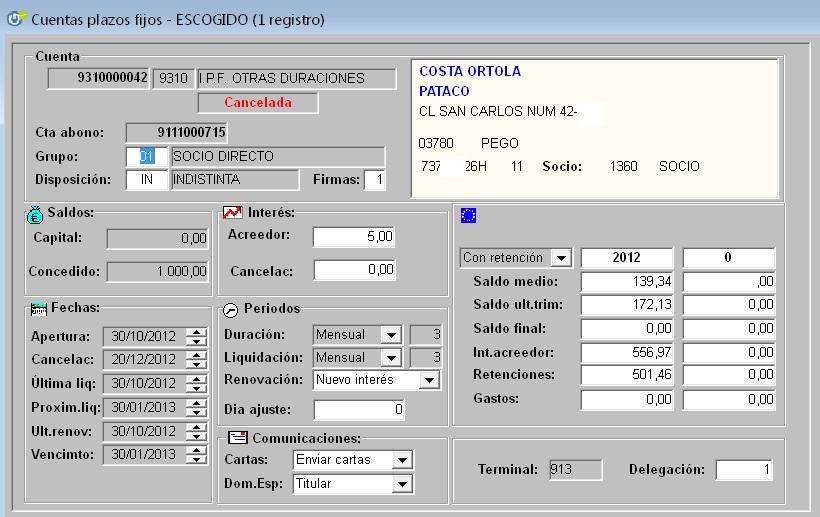

VisionCredit Fintech - Screenshot 1

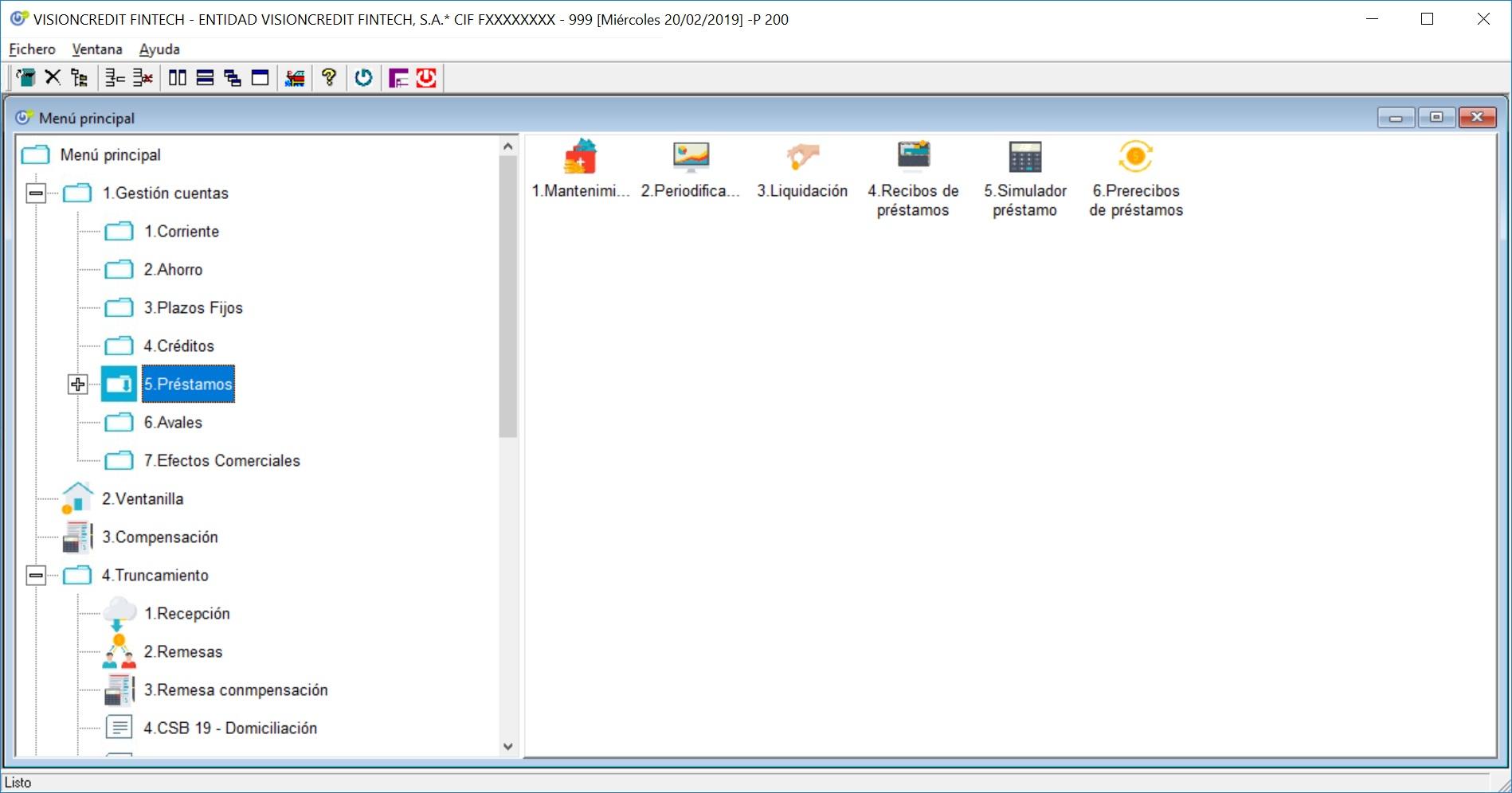

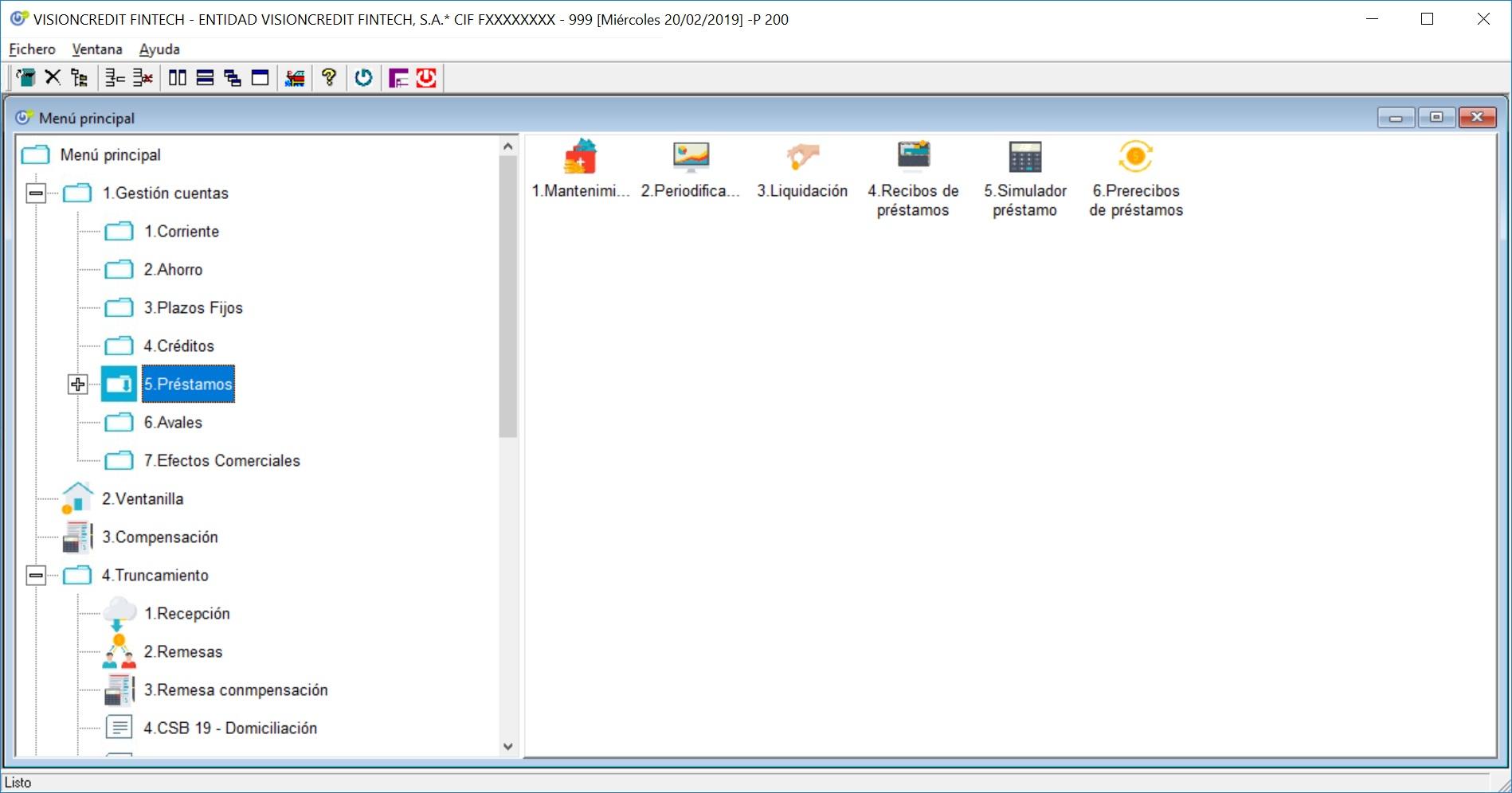

VisionCredit Fintech - Screenshot 1  VisionCredit Fintech - Screenshot 2

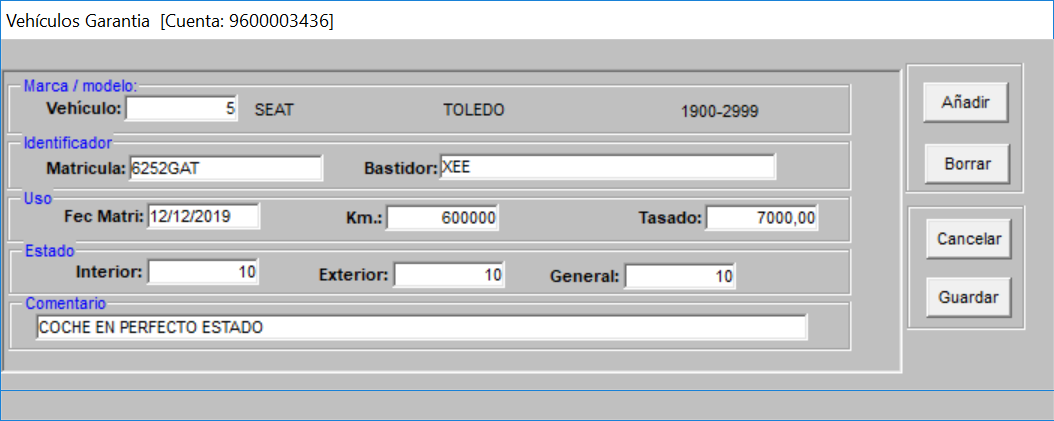

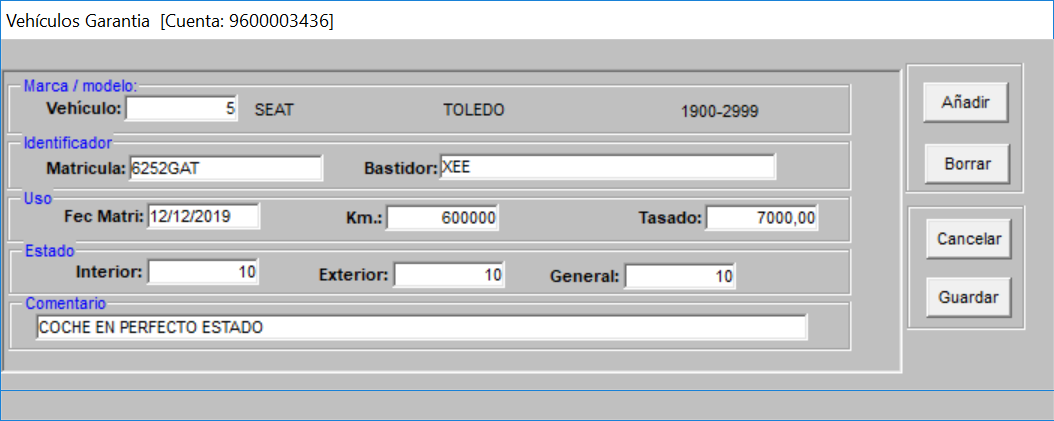

VisionCredit Fintech - Screenshot 2  VisionCredit Fintech - Screenshot 3

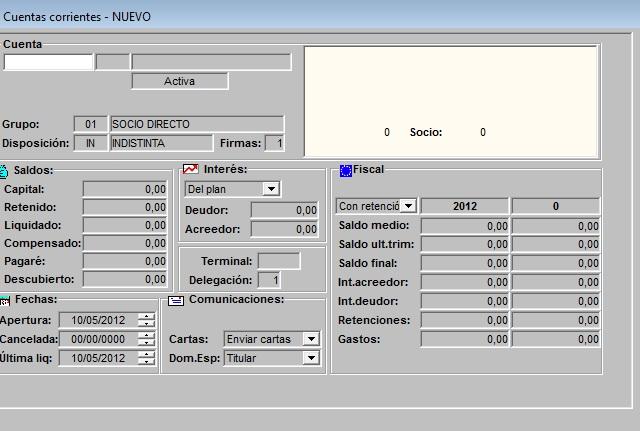

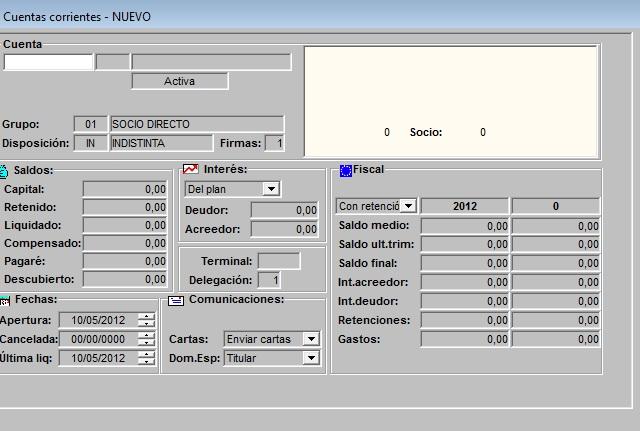

VisionCredit Fintech - Screenshot 3  VisionCredit Fintech - Screenshot 4

VisionCredit Fintech - Screenshot 4  VisionCredit Fintech - Screenshot 5

VisionCredit Fintech - Screenshot 5  VisionCredit Fintech - Screenshot 6

VisionCredit Fintech - Screenshot 6

VisionCredit Fintech: its rates

Gratuita

Free

Esential

US$999.00

/user

Gold

Rate

On demand

Standard

Rate

On demand

Clients alternatives to VisionCredit Fintech

Optimize your financial processes with desktop publishing software. Save time and increase efficiency with Esker | S2P & O2C.

See more details See less details

Esker | S2P & O2C is desktop publishing software that makes it easy to manage the buying and selling process. Thanks to its advanced features, you can automate repetitive tasks, reduce errors and improve the visibility of your financial operations.

Read our analysis about Esker | S2P & O2CTo Esker | S2P & O2C product page

Automate debt collection with ease using this software. Track and manage debts, automate reminders, and improve cash flow.

See more details See less details

With this debt collection software, you can easily manage all your outstanding debts from a single platform. Set up automated reminders and track payment history to improve your cash flow. The software also provides real-time analytics and reporting to help you make informed decisions.

Read our analysis about Hoopiz Credit ManagementBenefits of Hoopiz Credit Management

Coverage of the entire sales-to-cash chain

Modular: Recovery, credit insurance,...

Ease of use and speed of installation

To Hoopiz Credit Management product page

Streamline debt recovery with this effective solution featuring automated reminders, analytics, and custom reporting for optimal cash flow management.

See more details See less details

This debt collection software enhances the efficiency of the recovery process by offering automated reminders and follow-ups, ensuring that no payment is overlooked. It includes robust analytics tools to provide insights into collection performance and trends, alongside custom reporting features that allow users to tailor reports according to their specific needs. These functionalities aid businesses in maintaining optimal cash flow management while reducing the manual effort required in debt recovery tasks.

Read our analysis about BillabexBenefits of Billabex

Autonomy (operates without manual intervention)

Integration with all invoicing software

Multilingual (Supports over 80 languages)

To Billabex product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.