Wallester : Create, issue, and manage your own payment cards

Wallester: in summary

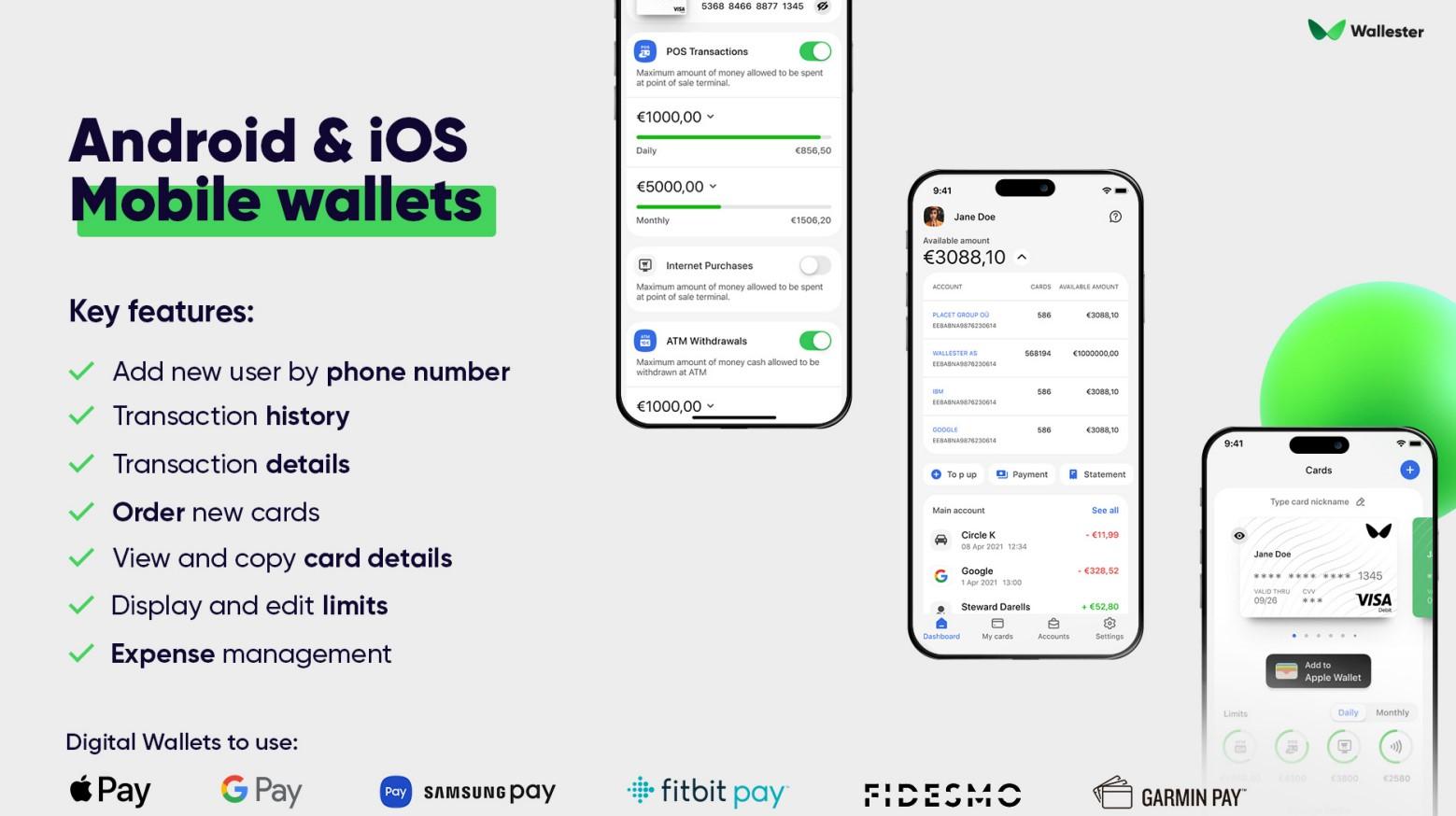

Wallester is a B2B platform for card issuing and processing. In other words, it is designed for companies looking to launch and manage a fully customisable payment card programme without relying on their own banking infrastructure. It enables the issuance of Visa cards—virtual or physical—with immediate debit, deferred debit, prepaid or single-use options, all of which can be integrated with Apple Pay, Google Pay, or Samsung Pay, and delivered under a white-label model.

This is a modular solution intended for fintechs, HR departments, marketplace platforms, gift card issuers, and companies operating in the gig economy.

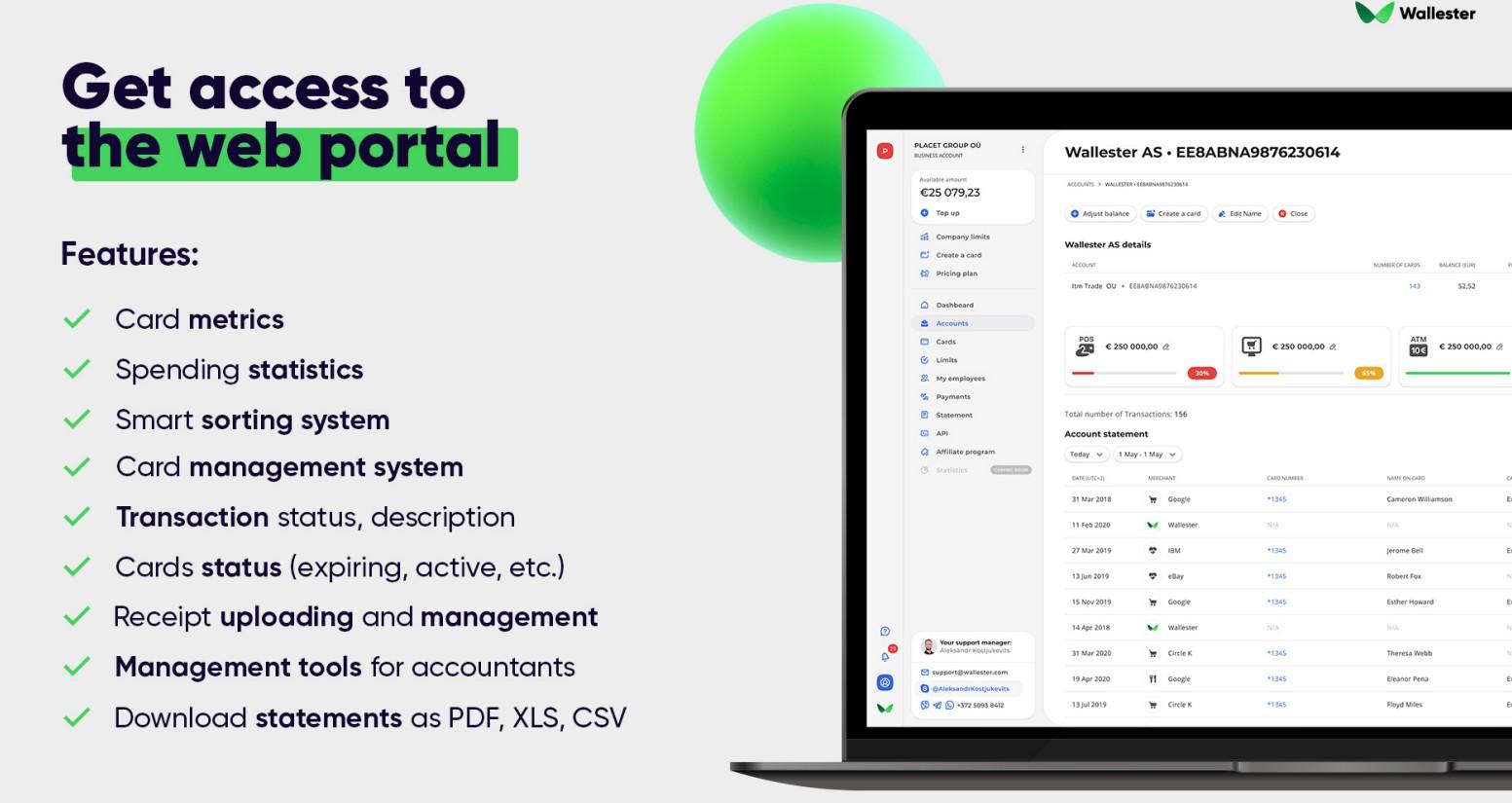

It offers centralised tools for:

- managing payment flows,

- real-time transaction monitoring,

- applying dynamic rules (spending policies),

- segmentation via sub-accounts,

- and automated accounting exports.

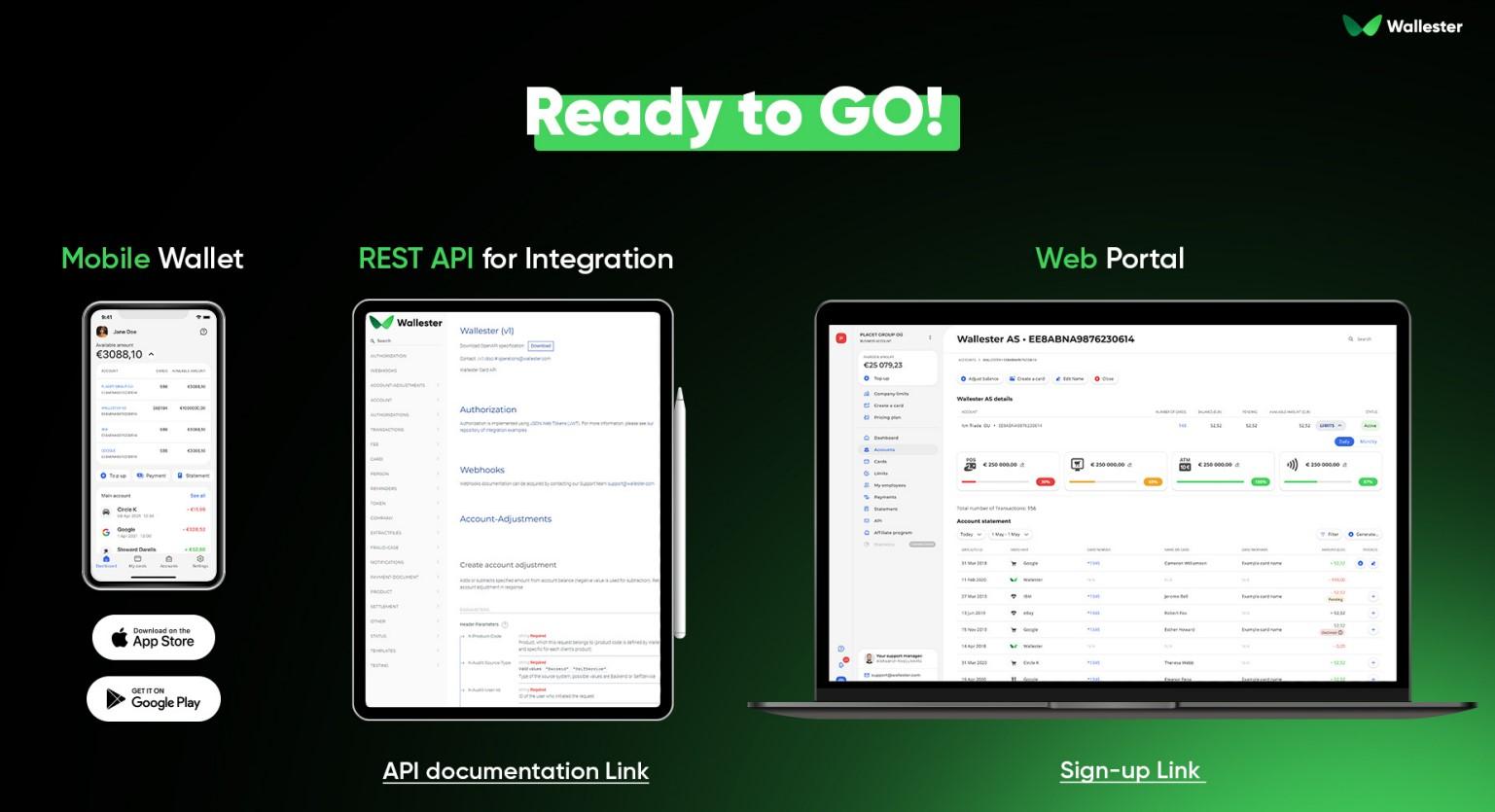

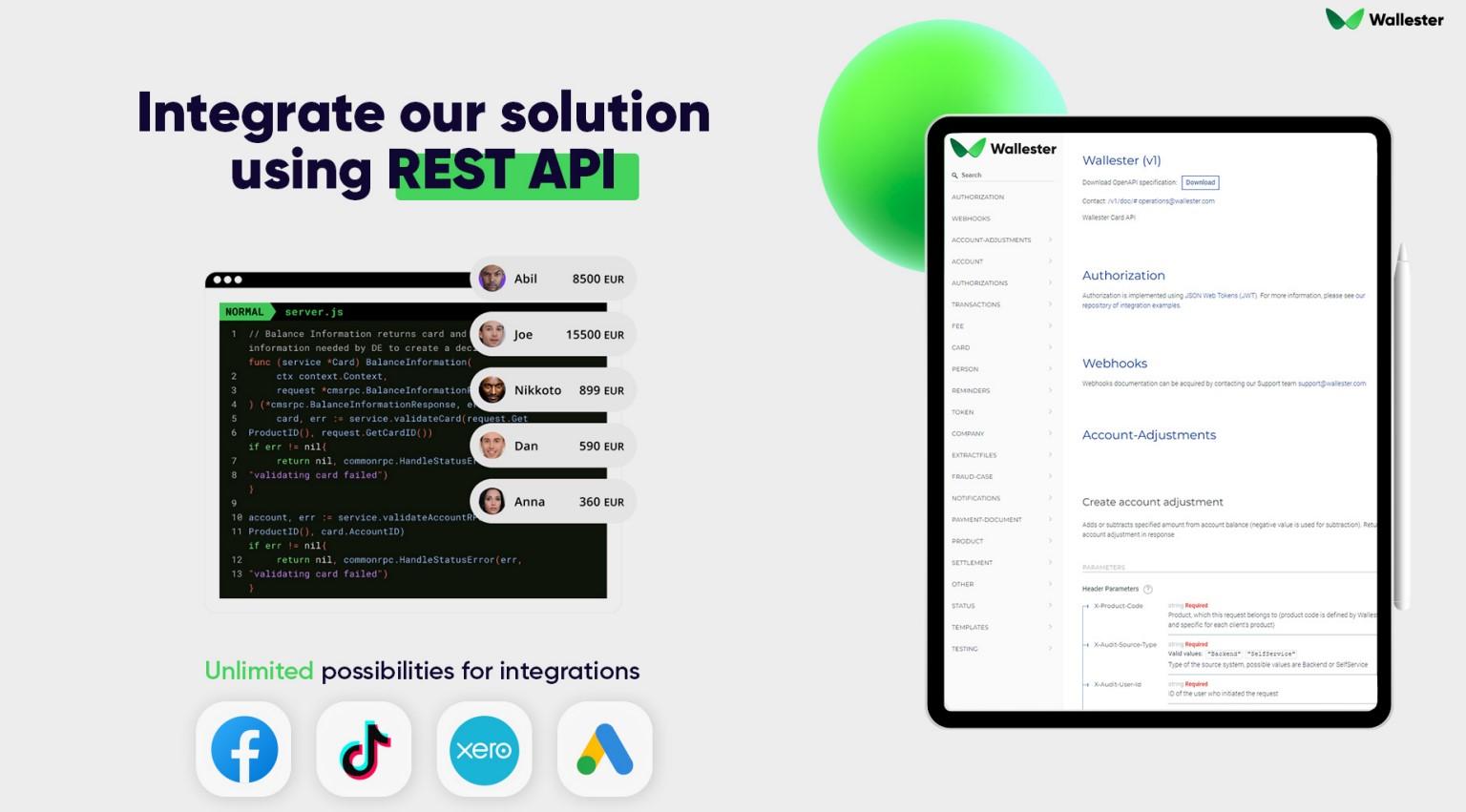

The web interface and RESTful API allow seamless integration with third-party systems (ERP, CRM, accounting tools), backed by a complete compliance framework (PCI DSS, KYC/KYB, AML, 3D Secure 2.0).

What are the main features of Wallester?

REST API & white-label portals

Wallester provides a full REST API with resource-based URLs, standard HTTP codes, and technical documentation on GitHub.

- Automated issuance of virtual/physical cards via API.

- Customisation of client portals and branded mobile applications.

- Integration with accounting systems (e.g., QuickBooks), CRM, and ERP platforms.

Instant Visa card issuance

Wallester enables the immediate issuance of virtual and physical cards, including a EUR IBAN.

- Single-use cards for one-off purchases.

- Physical cards for employees without digital access.

- Mass issuance for fleets, logistics, yachting, gig economy.

Expense management & integrated reporting

The platform offers real-time expense tracking, receipt submission, exportable reports, and accounting synchronisation via API.

- Budget tracking by department, project, or sub-account.

- Data export to Excel, ERP, or cloud-based accounting systems.

- Centralised digital archive for receipts.

Security, compliance, and tokenisation

Wallester complies with PCI DSS, PSD2, KYC/KYB/AML standards and supports tokenisation for Apple Pay, Google Pay, Samsung, Fitbit, Garmin, and 3D Secure 2.0.

- Cards compatible with secure mobile wallets.

- Strong customer authentication using 3D Secure under EU regulations.

- Fraud monitoring and filtering of suspicious transactions.

BIN sponsorship & Visa network integration

As a principal Visa member, Wallester offers sponsored BINs in line with VISA/EMV standards.

- Launch card programmes without requiring a banking licence.

- Issue loyalty, prepaid, gift, or membership cards.

Industry-specific solutions

Wallester delivers tailored solutions for businesses, fintechs, streaming platforms, gig economy, logistics, gift card schemes, yachting, and more.

- Instant payouts to drivers and couriers using zero-balance cards.

- Immediate access to earnings for creators and streamers.

- Multi-purpose gift cards with configurable limits.

Why choose Wallester?

- Comprehensive ready-to-use solution: onboarding, card issuing, and reporting in just three steps.

- Suited to all sectors: fintech, e-commerce, logistics, streaming, gig platforms, gift cards.

- Advanced security & compliance: PCI DSS, PSD2, tokenisation, 3D Secure, fraud protection.

- Direct Visa integration: launch branded cards without a banking licence.

- Cost-effective: permanent free plan, multi-currency support, tiered pricing model.

Its benefits

300 virtual cards for FREE

No top-up fee, no service fee

Multiple currencies available - EUR, USD, CZK, RON, SEK, NOK, HUF

iOs/Android wallets and REST API

Payroll cards

PCI-DSS

Its disadvantages

Complexity may require technical expertise

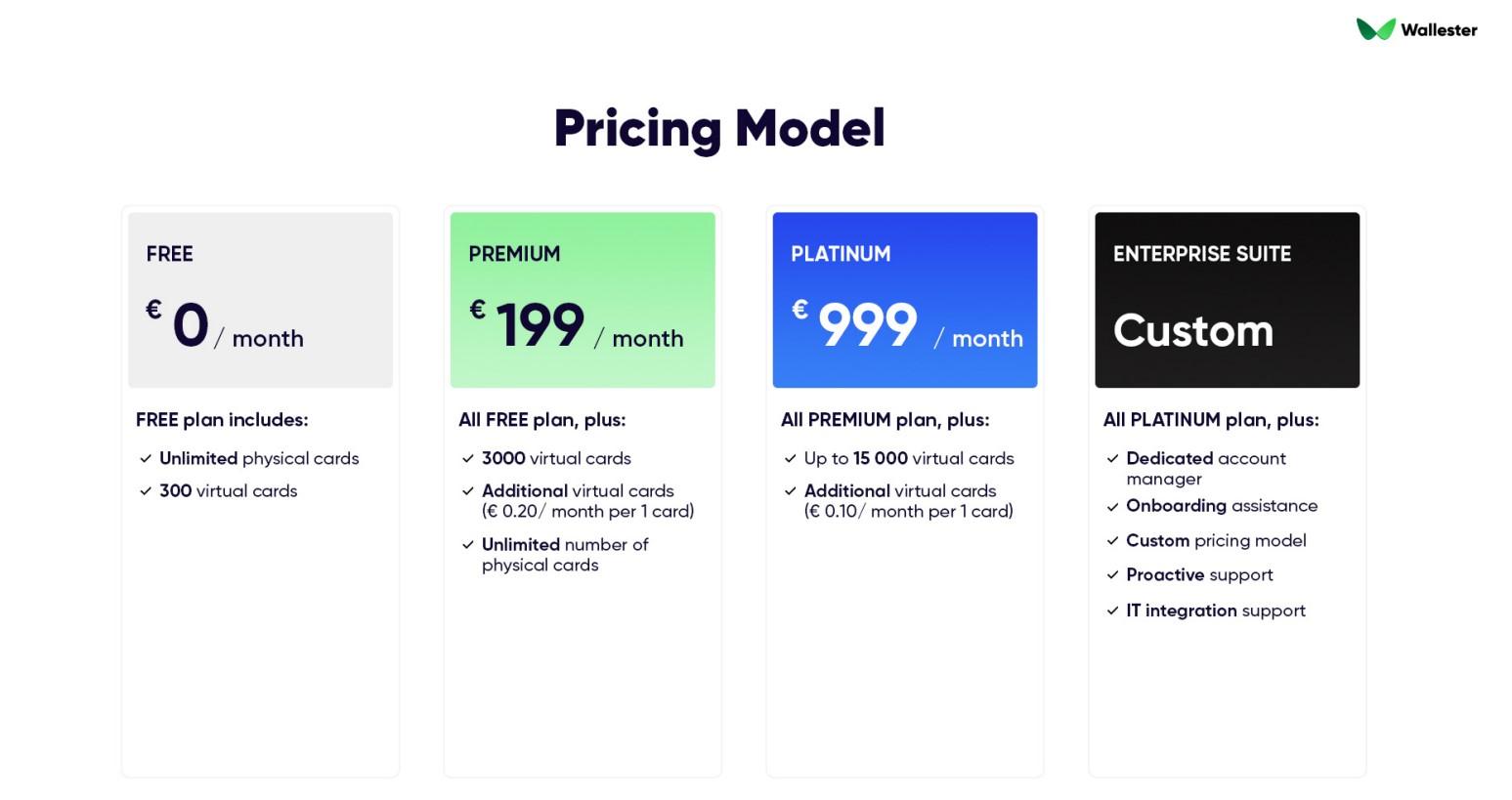

Wallester: its rates

FREE

Free

PREMIUM

€199.00

/month /unlimited users

PLATINUM

€999.00

/month /unlimited users

ENTERPRISE SUITE

Rate

On demand

Clients alternatives to Wallester

Manage your invoices and quotes efficiently with intuitive software. Track your payments and reminders in real time.

See more details See less details

With Sellsy Facturation & Gestion, you can create invoices and quotes in just a few clicks, customise your templates and send them directly to your customers. Payments and reminders are automatically tracked, saving you considerable time.

Read our analysis about Sellsy FacturationTo Sellsy Facturation product page

Global money transfers, multi-currency accounts, and seamless payment solutions for businesses of all sizes.

See more details See less details

Airwallex offers comprehensive features, including global money transfers in multiple currencies, allowing businesses to engage in cross-border transactions with ease. It provides multi-currency accounts, enabling users to hold and manage funds in various currencies without unnecessary conversion fees. With its seamless payment solutions tailored for various business needs, Airwallex empowers companies to streamline their financial operations and enhance customer experiences efficiently.

Read our analysis about AirwallexTo Airwallex product page

Streamlines payment processing with key feature integrations for businesses of all sizes.

See more details See less details

Market Pay stands out as a Payment Processing software by streamlining payment handling for enterprises across the board. This platform integrates essential features such as multi-currency support, secure transaction processing, and customizable payment gateways, making it an indispensable tool for businesses aiming to enhance their transactional efficiency and security.

Read our analysis about Market PayBenefits of Market Pay

2.4 billion managed transactions

160 000 managed terminals

30 billion acquired flows

To Market Pay product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.