Cashlab : Cash management and forecasting software

Cashlab: in summary

Cashlab is a sophisticated software solution designed to streamline and enhance cash management for businesses of all sizes, from SMEs to large corporations. With a focus on automation and accuracy, Cashlab offers a range of features including real-time cash flow forecasting, detailed financial reporting, and seamless integration with multiple banking systems. Its user-friendly interface and powerful analytics tools help financial managers make informed decisions, ensuring better cash visibility and control.

What are the main features of Cashlab?

Comprehensive Cash Flow Forecasting

Cashlab enables businesses to predict and manage their cash flow with precision, using both direct and indirect forecasting methods. This feature helps in aligning operational budgets with cash budgets over extended periods, providing a clear picture of financial health.

- Direct and indirect cash flow forecasting

- Monthly and annual cash projections

- Automated adjustments for financial laws, CAPEX, and financing

- Scenario planning and variance analysis

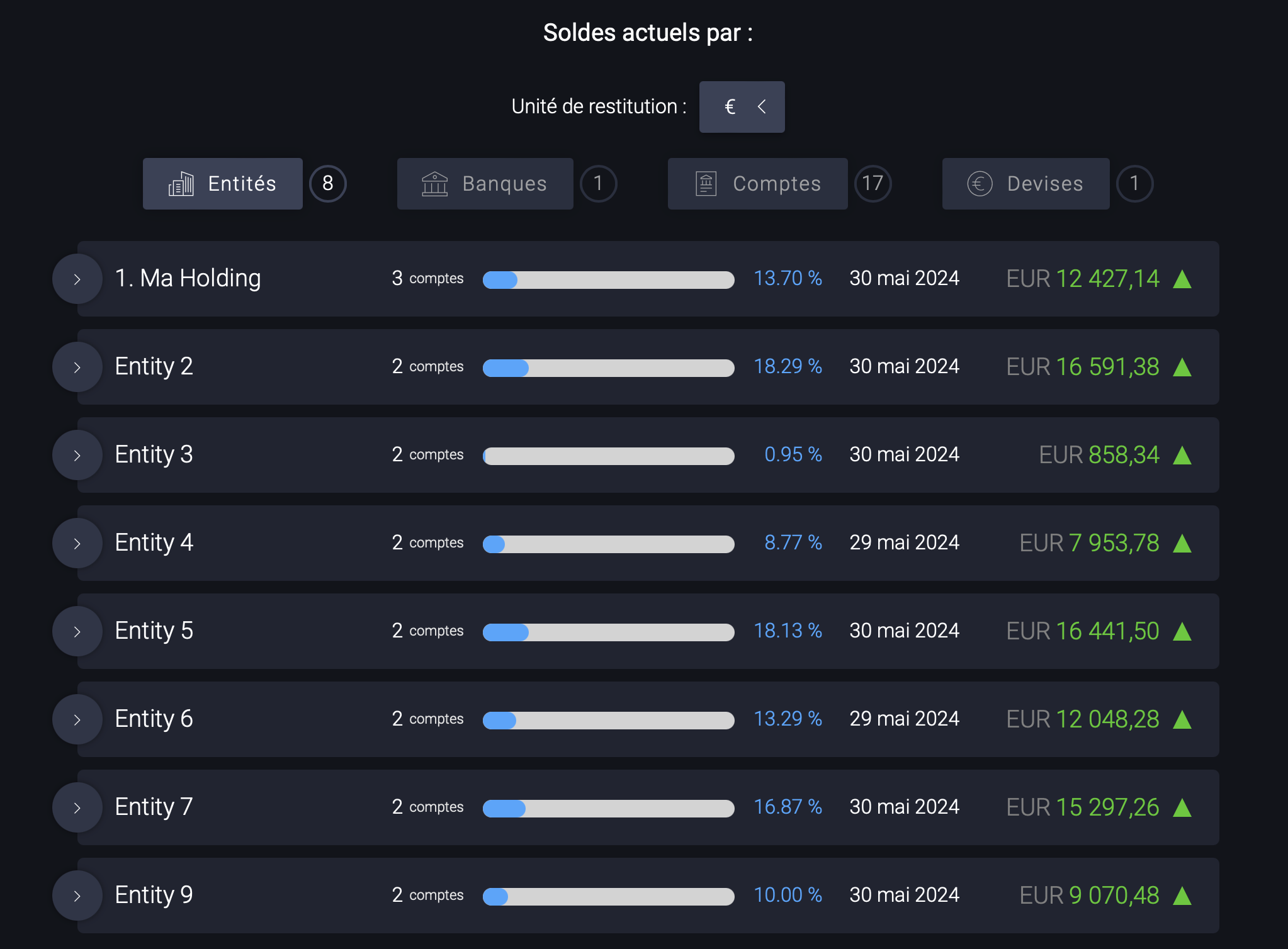

Real-Time Banking Integration

With Cashlab, you can connect multiple bank accounts and entities, allowing for real-time monitoring of cash positions. This feature simplifies the complexity of managing finances across different banks and currencies.

- API connections to various banks

- Real-time cash balance monitoring

- Multi-bank, multi-entity, and multi-currency support

- Automated transaction categorization

- Cash-burn analysis

Advanced Financial Reporting

Cashlab's reporting capabilities transform raw financial data into insightful reports that are crucial for strategic decision-making. The platform offers ready-to-use reporting packs that save time and enhance communication with stakeholders.

- Detailed financial statements: P&L, balance sheet, and cash flow statements

- Customizable reporting packs for management and investors

- Historical data analysis and graphical representations

- Consolidation of financial reports across multiple entities

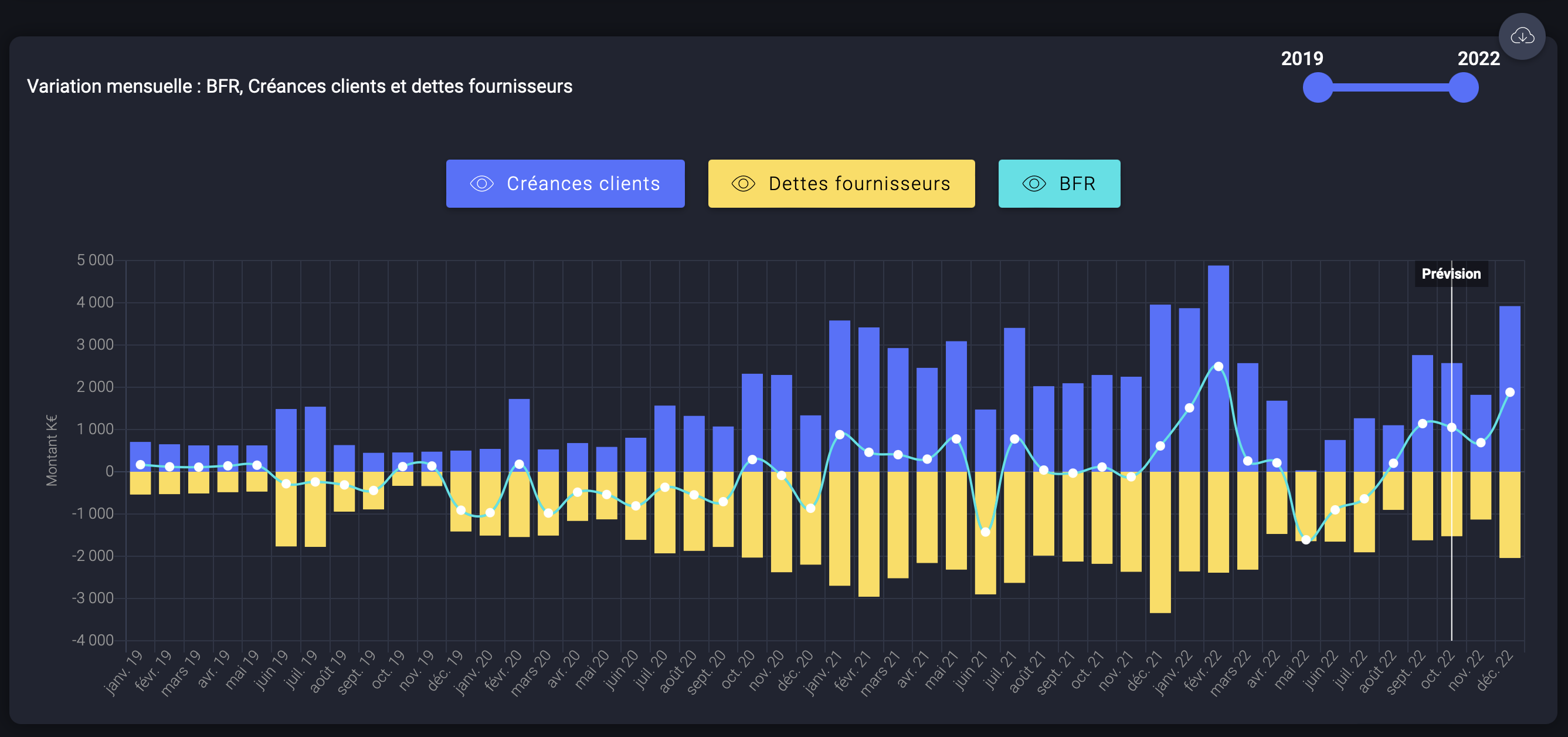

Optimization of Working Capital

Cashlab provides tools to optimize your working capital by analyzing key performance indicators (KPIs) and identifying areas for improvement. This feature is essential for maintaining liquidity and supporting business growth.

- Automatic calculation of KPIs like DSO, DIO, and DPO

- Performance diagnostics and optimization recommendations

- Monthly tracking of debt and bank covenants

- Strategic insights for improving cash conversion cycles

Secure and Scalable SaaS Platform

Security is a top priority for Cashlab, which complies with stringent data protection standards. The software is available in multiple languages, making it accessible for international teams.

- ISO/IEC 27001, CSA STAR, SOC 1 & SOC 2 compliance

- 100% SaaS solution with high availability

- Available in 7 languages: English, French, Italian, Spanish, German, Dutch, and Swedish

- Secure API connections for data integrity

Cashlab stands out in the market with its comprehensive approach to cash management, providing businesses with the tools they need to optimize their cash flow and financial health effectively.

Its benefits

Time saved (80%) compared to using Excel

Strategic cash vision

Personalised advice

PCI-DSS, GDPR, DSP2, SecNumCloud

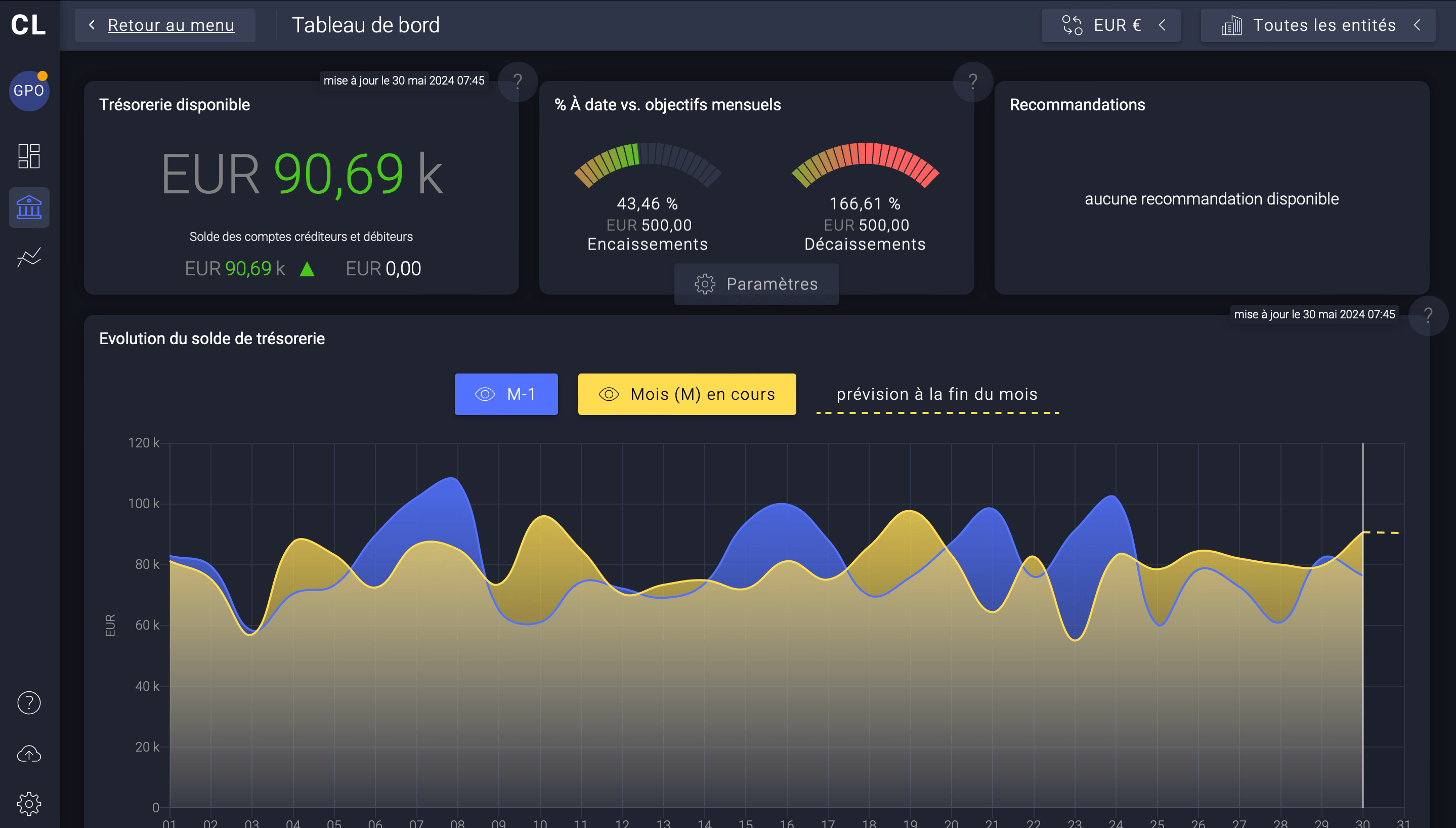

Cashlab - Dashboard: available cash flow, cash collection/disbursement targets, changes in your cash position

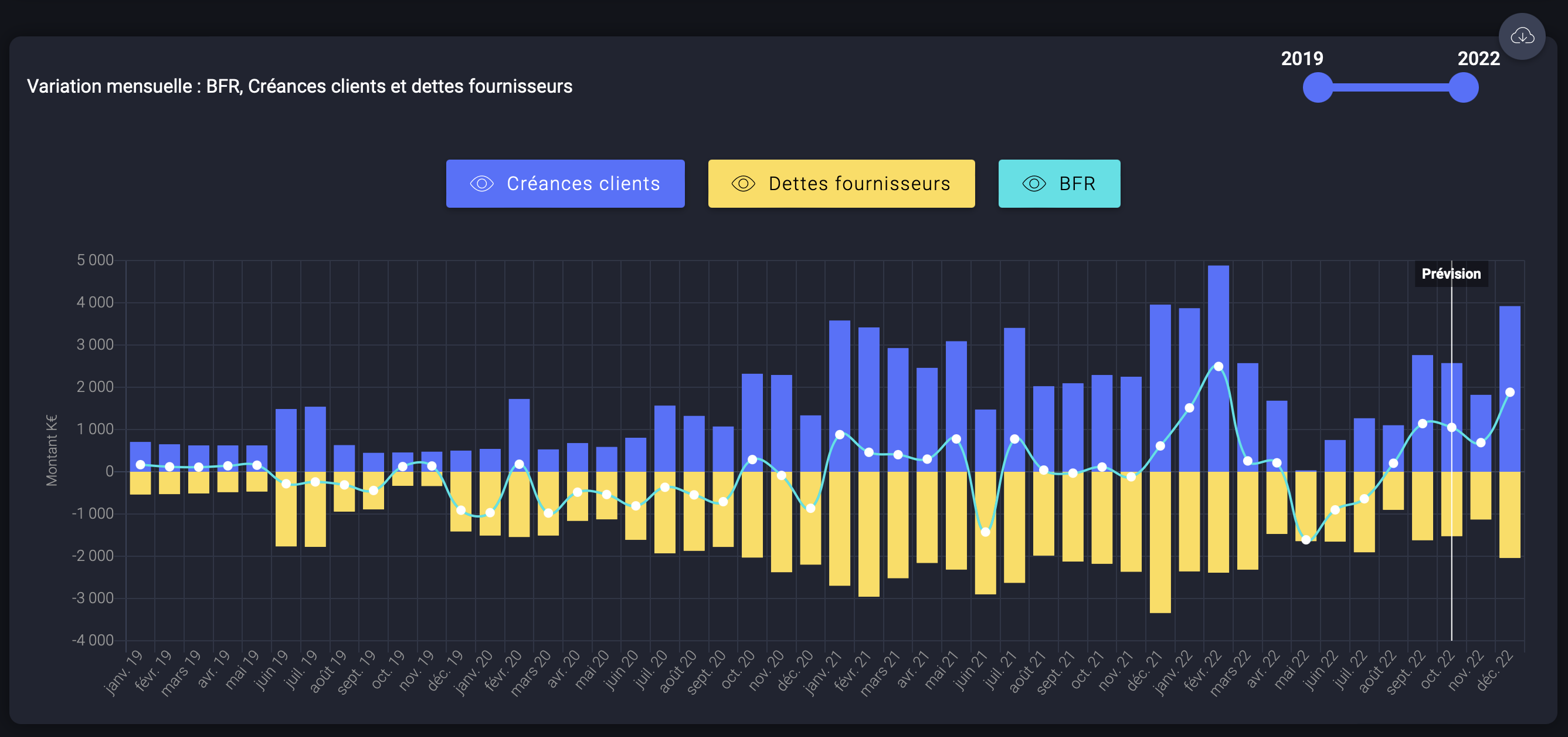

Cashlab - Dashboard: available cash flow, cash collection/disbursement targets, changes in your cash position  Cashlab - Analysis of WCR KPIs: DSO, DIO, DPO

Cashlab - Analysis of WCR KPIs: DSO, DIO, DPO  Cashlab - Observation of indicators

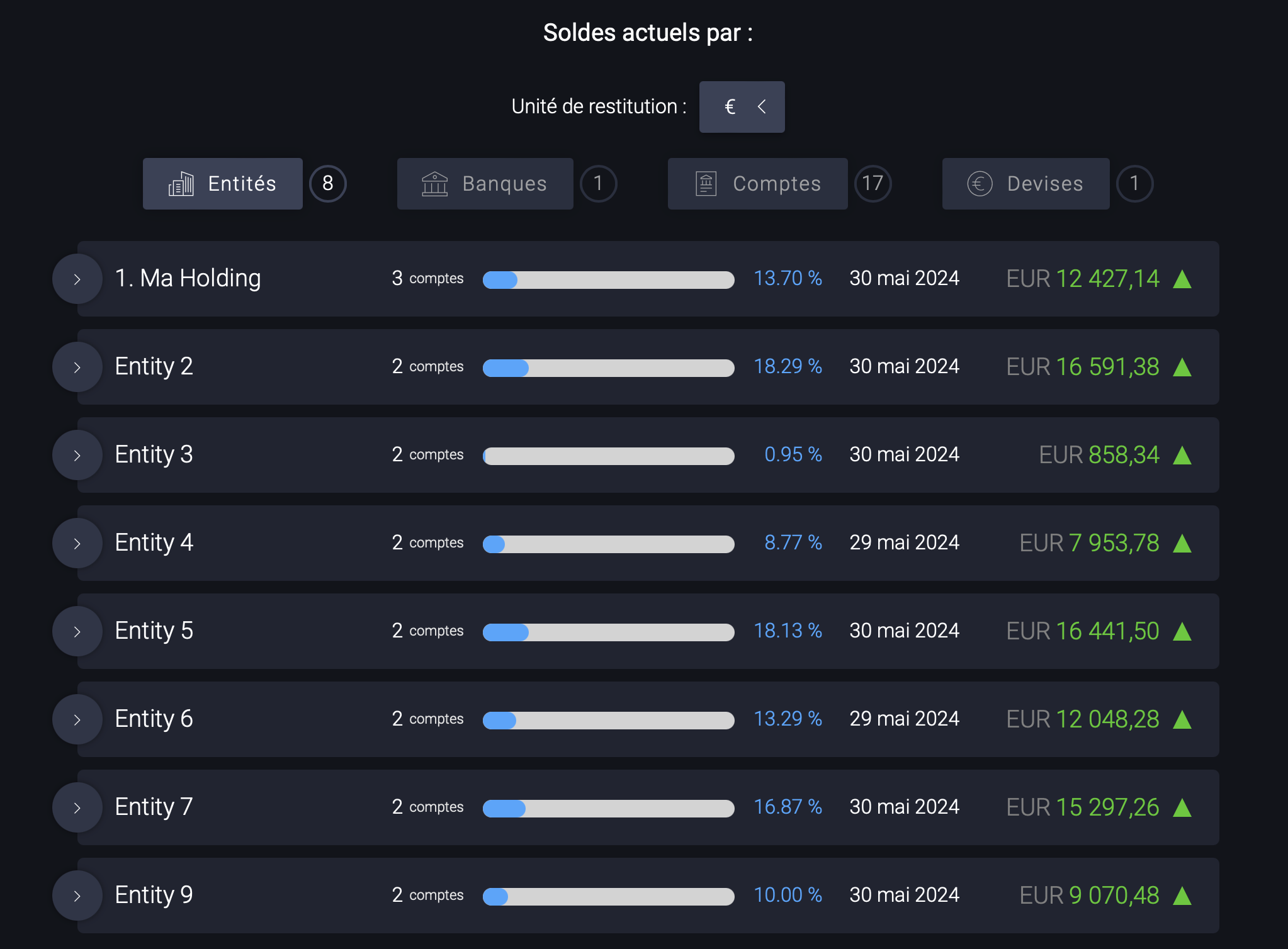

Cashlab - Observation of indicators  Cashlab - Current balances by entity, bank, account and currency

Cashlab - Current balances by entity, bank, account and currency

Cashlab: its rates

Standard

Rate

On demand

Clients alternatives to Cashlab

Manage your cash flow efficiently with intuitive management software. Track your cash flow, forecast your expenses and manage your invoices with ease.

See more details See less details

Sellsy Gestion de trésorerie is a comprehensive cash management software package that allows you to monitor and analyse your cash flow in real time. It enables you to forecast your expenditure and manage your invoices with ease.

Read our analysis about Sellsy TrésorerieTo Sellsy Trésorerie product page

Streamline your customer interactions with a powerful CRM software. Manage your leads, deals, and tasks all in one place.

See more details See less details

Increase your sales efficiency with Axonaut's CRM software. Automate your workflow, track customer interactions, and get detailed reports to make informed decisions. With Axonaut, you can focus on building relationships with your customers and growing your business.

Read our analysis about AxonautBenefits of Axonaut

Easy to use

Affordable

All-in-one

To Axonaut product page

Streamline your treasury management with our software. Manage cash, liquidity, and risk with ease.

See more details See less details

Our treasury management system provides real-time visibility into cash positions, automates cash forecasting, and enables accurate risk management. With Fygr, you can optimize your cash management processes and make informed decisions about investments and financing.

Read our analysis about FygrTo Fygr product page

Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.