Tip • 17 October 2024

The top 12 forged expense claims and software to prevent fraud

False expense claims are costly for companies. Discover all the tricks of the fraudsters and choose the right software to prevent abuse!

Definition What is the 2020 cycle kilometre allowance and how does it work? Are you a manager who would like to know more about the kilometre-based allowance for cycling in 2022? Find out the full definition, conditions and benefits!

Word from the expert Expense reports: Win at every cost Sara Jaillet, Data Analyst for Philéas Gestion, reviews the steps and costs involved in processing expense claims, and shows you how to save time and money by optimising the management of your expense claims.

Tip Urssaf and expense claims: how can you avoid being reassessed? How can you manage your expense claims to avoid having to pay Urssaf? Find out how to reimburse business expenses and the best practices to apply.

Tip • 17 October 2024

The top 12 forged expense claims and software to prevent fraud

False expense claims are costly for companies. Discover all the tricks of the fraudsters and choose the right software to prevent abuse!

Tip • 17 October 2024

Why and how to switch to a meal voucher card

The meal voucher card is designed to replace luncheon vouchers. Benefits for both employers and employees, how it works... here's some advice on how to successfully dematerialise your meal vouchers!

Definition • 17 October 2024

Calculating fuel costs: 2024 scale

What are fuel costs and when can they be deducted? What are the latest scales issued by the authorities? We tell you everything.

Definition • 17 October 2024

What is an engagement order and what does it have to say? (+ free template to download)

Are you a manager who would like to know more about mission orders? Take a look at our explanatory article and download a free template!

Definition • 17 October 2024

Mileage expenses: definition and basic rules

Find out about the definition, scales and basic rules for your mileage expenses, whether for business travel or for journeys between home and work.

Tip • 17 October 2024

Everything you need to know about the rules governing business travel

What does the law say about business travel? What are the rules on working hours, reimbursement of expenses and management?

Navan

Corporate travel management

Learn more about Navan

Regate by Qonto

Accounting Practice Management

Learn more about Regate by Qonto

Bolt Business

Corporate travel management

Learn more about Bolt Business

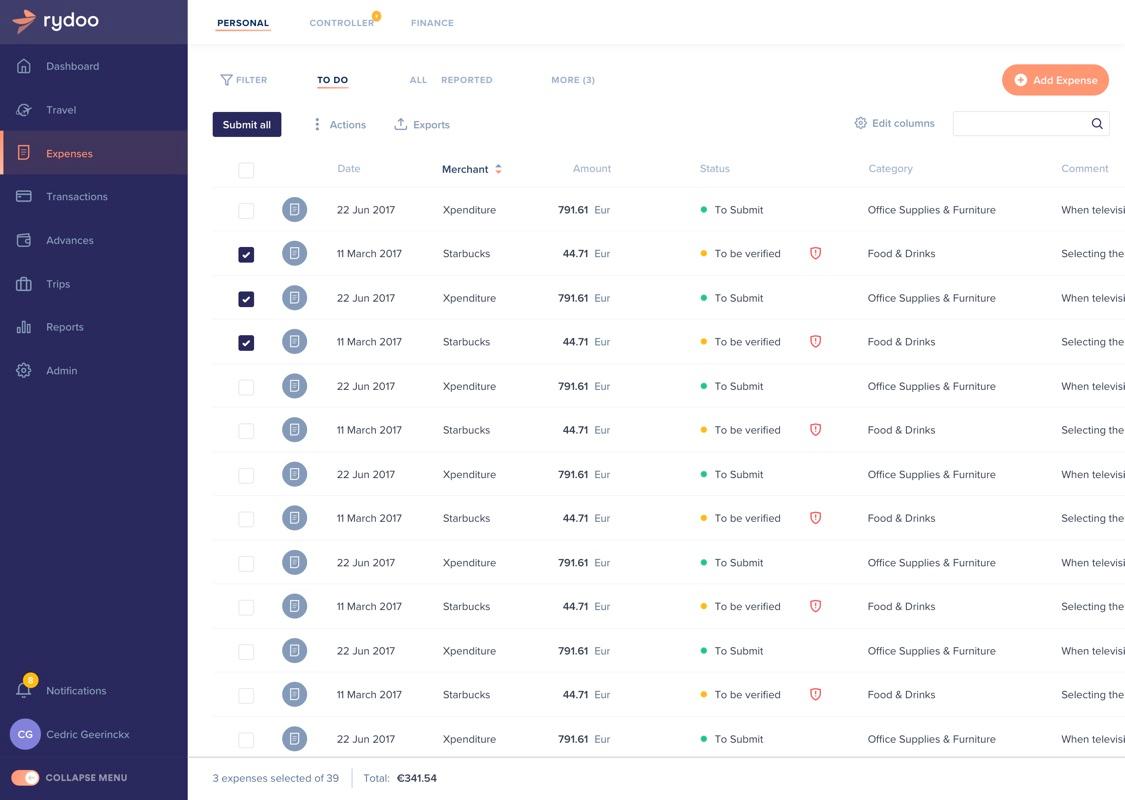

Rydoo

Expense Management

Learn more about Rydoo

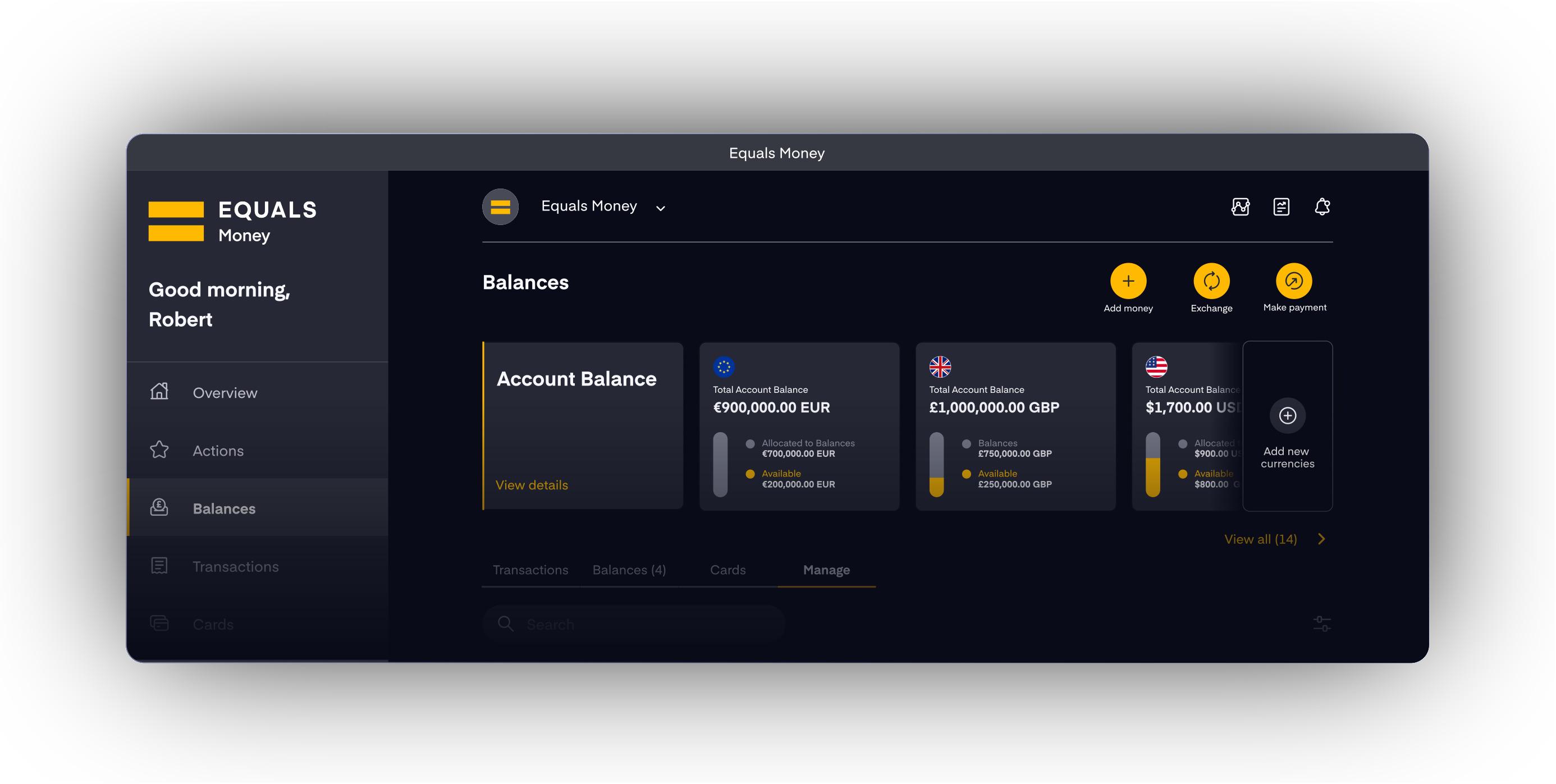

Equals Money

Expense Management

Learn more about Equals Money

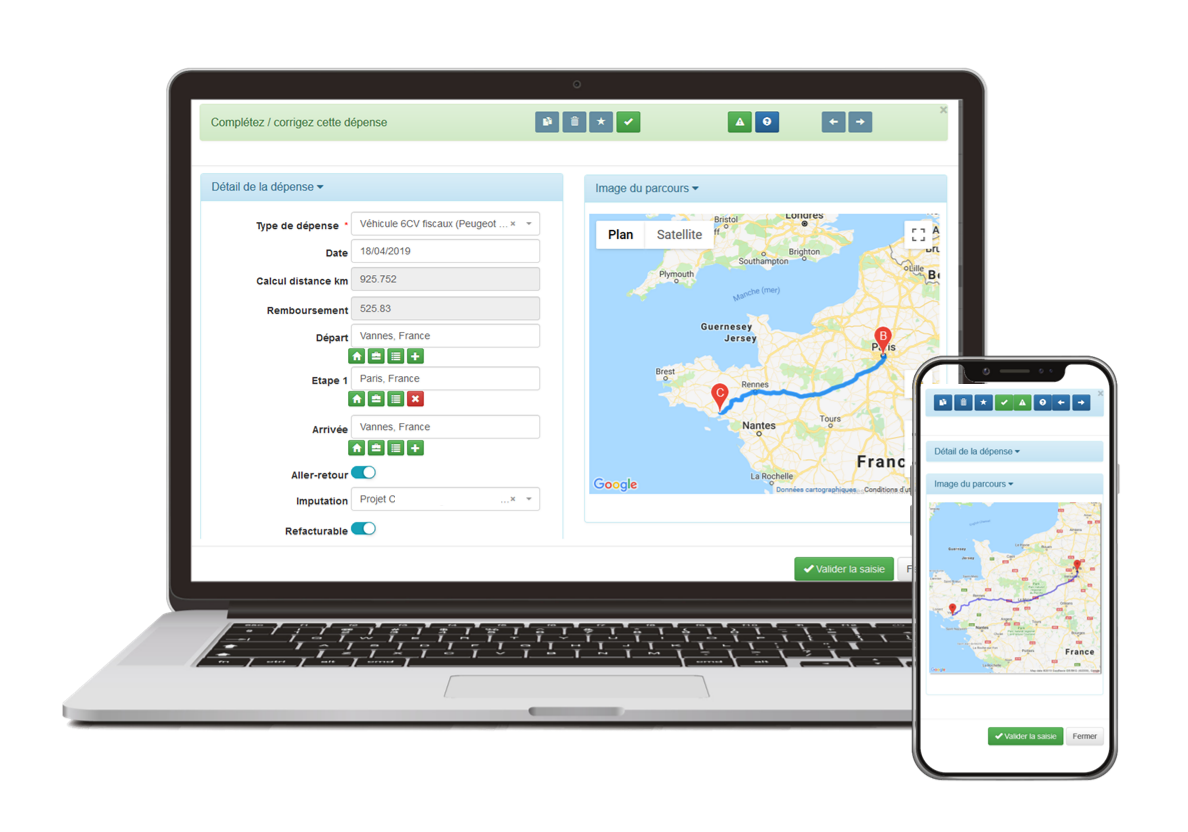

VERTICAL EXPENSE

Expense Management

Learn more about VERTICAL EXPENSE

Carlatravel

Expense Management

Learn more about Carlatravel

Divvy

Expense Management

Learn more about Divvy

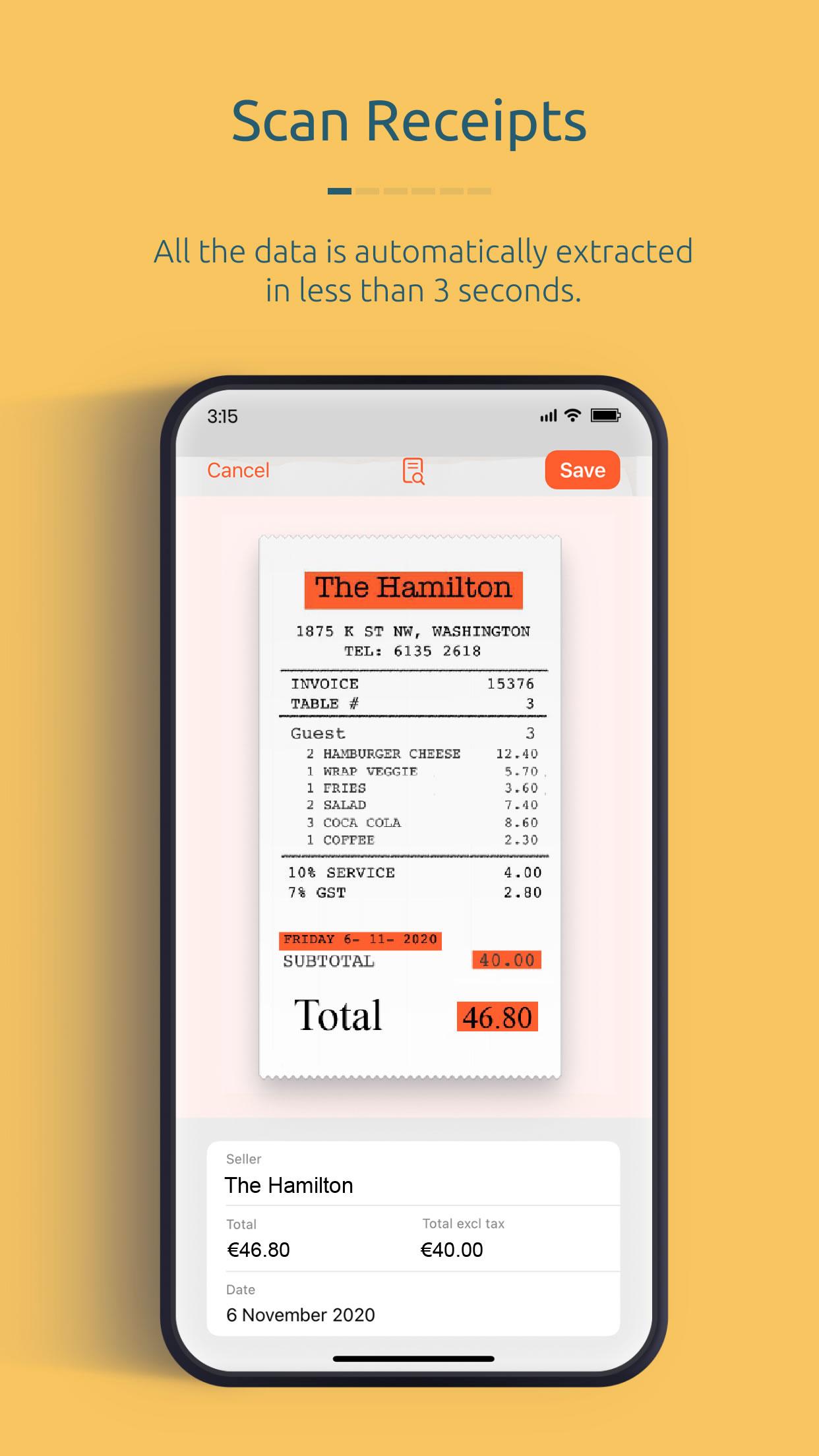

Fyle

Expense Management

Learn more about Fyle

MyExpensesOnline

Expense Management

Learn more about MyExpensesOnline

Silae Expense

Expense Management

Learn more about Silae Expense

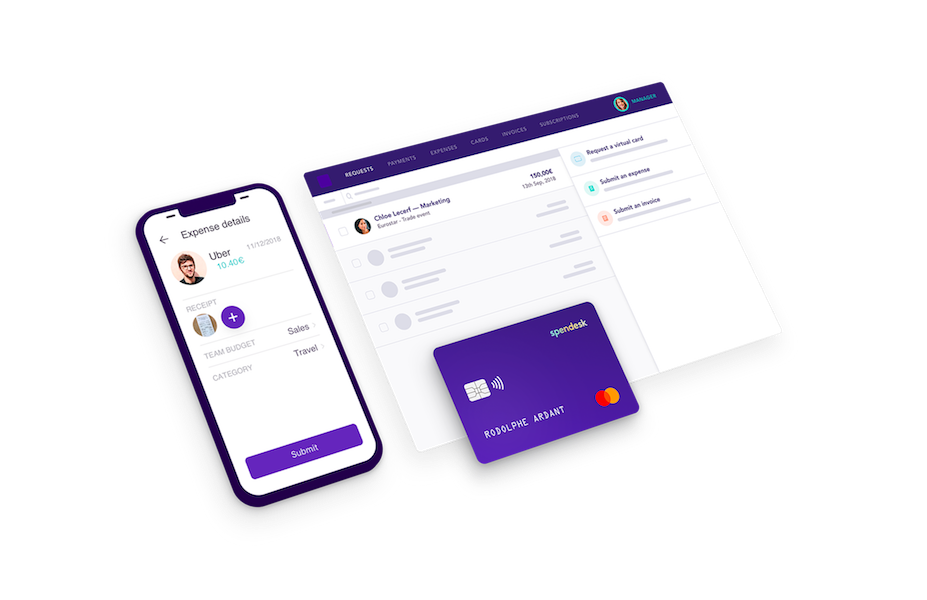

Spendesk

Expense Management

Learn more about Spendesk

Tip • 17 October 2024

Recording, VAT: how do you manage expense claims in your accounts?

Your aim: to spend as little time as possible recording your expense claims in your accounts. Good news: our guide will help you do just that!

Tip • 17 October 2024

How do you calculate a mileage allowance in 2024? Scale and calculation model

It's a long way from getting your mileage reimbursed. Take a break in this article: we'll explain how to make a mileage allowance in line with the 2024 scale.

Definition • 17 October 2024

All the secrets of the business card for managing company expenses

The business card: you've heard of it but don't know exactly what it's all about? Why use it and how does it work? Find out in this article!

Tip • 17 October 2024

How do you manage meal expenses and what proof should you accept?

In what form are receipts for business expenses accepted? How do meal receipts work? It's time to eat!

Definition • 17 October 2024

What is an expense claim? Definition

Tip • 17 October 2024

Self-employed contractors: there's more to reimbursing professional expenses than expense claims

You run your own micro-business and have a lot of business expenses. Can you submit an expense claim for reimbursement? Here's how.

Definition • 17 October 2024

Business meal expenses: deduction and reimbursement

What meal expenses can be reimbursed as business expenses or deducted from tax? What are the limits and conditions?

Definition • 17 October 2024

A to Z guide: everything you need to know about the specific flat-rate deduction

Also known as a lump-sum allowance for business expenses, the DFS has its share of advantages, disadvantages and rules to be observed. Who is affected and how is it calculated?

Definition • 17 October 2024

Business expenses and the construction industry: focus on the commuting allowance and transport expense allowances

What are commuting and transport allowances in the construction and public works sector? To what extent do they apply? We take a look at all the professional expenses incurred by construction workers.

Tip • 17 October 2024

Roll in gold with reimbursement of your Uber expenses

Would you like to process your Uber invoices efficiently as expense claims? Follow our methods and advice!

Tip • 17 October 2024

How can I reclaim VAT on expense claims?

VAT can be reclaimed on expense claims. Optimise your business expenses with deductible VAT! What rules apply? We explain.

Definition • 17 October 2024

Definition, list of business expenses and examples

What are the different types of business expenses eligible for reimbursement, and what are the Urssaf rates? List and examples to help you understand the basics!

Definition • 17 October 2024

Everything you need to know about keeping paper or electronic expense claims

Why should you keep your expense reports and for how long? What risks do you run in the event of an Urssaf inspection and failure to comply with the retention period? What about paperless invoicing?

Definition • 17 October 2024

All you need to know about the 2024 mileage scale

Find out all the Urssaf scales for reimbursing mileage expenses.