RiskEdge : Advanced Risk Management for Financial Excellence

RiskEdge: in summary

RiskEdge is designed to empower financial professionals with advanced risk management capabilities. Perfect for banks and financial institutions, it offers predictive analytics and real-time monitoring to optimise performance and mitigate risks effectively.

What are the main features of RiskEdge?

Predictive Analytics for Risk Forecasting

RiskEdge harnesses the power of predictive analytics to anticipate future trends and potential risks, providing users with the tools they need to prepare and respond proactively.

- Data-Driven Insights: Leverage historical data to identify patterns and predict future outcomes.

- Customisable Models: Tailor prediction models to suit your specific market needs.

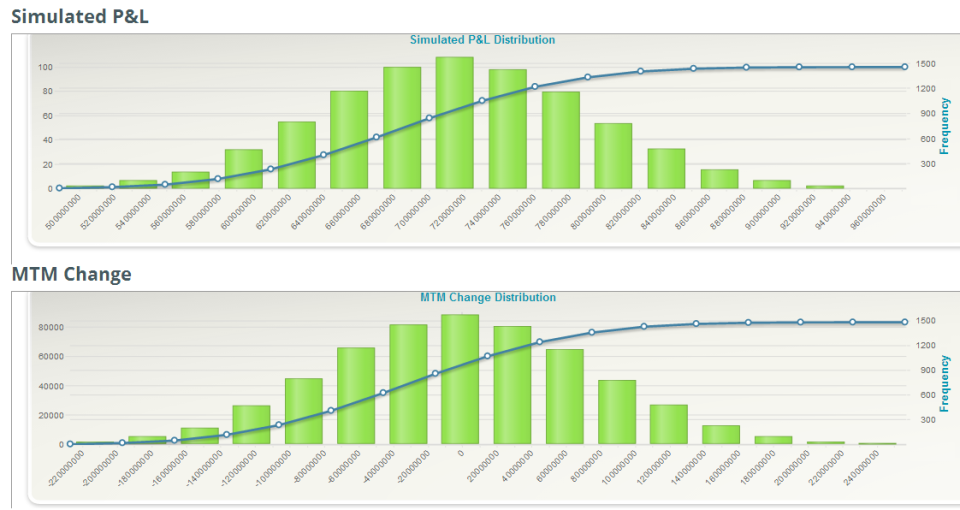

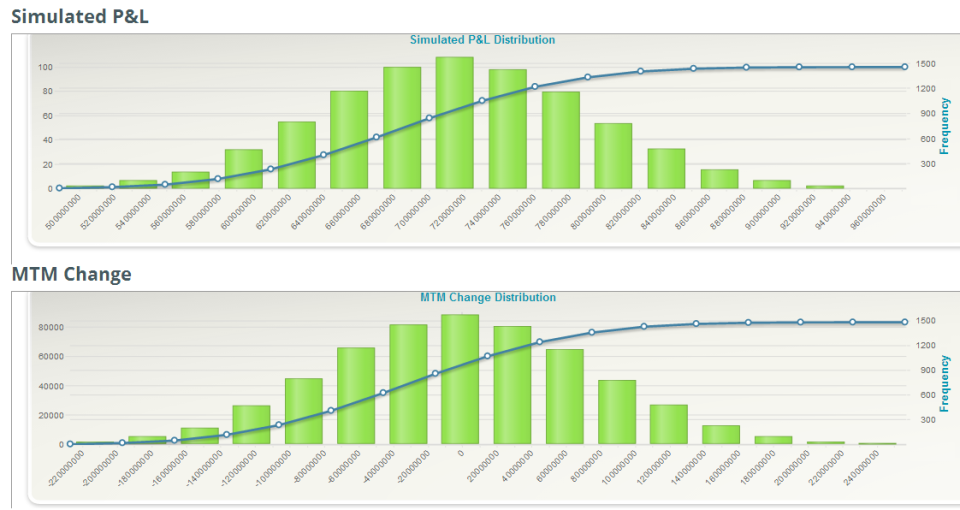

- Scenario Analysis: Explore various scenarios to anticipate different market conditions.

Real-Time Risk Monitoring

Stay ahead of market fluctuations with real-time monitoring that keeps you informed and ready to react swiftly to any changes.

- Live Data Feeds: Access to up-to-the-minute market data ensures that you stay informed.

- Instant Alerts: Set up alerts for potential risks so you're always prepared.

- Comprehensive Dashboards: Dashboards offer a clear view of risk metrics across various sectors.

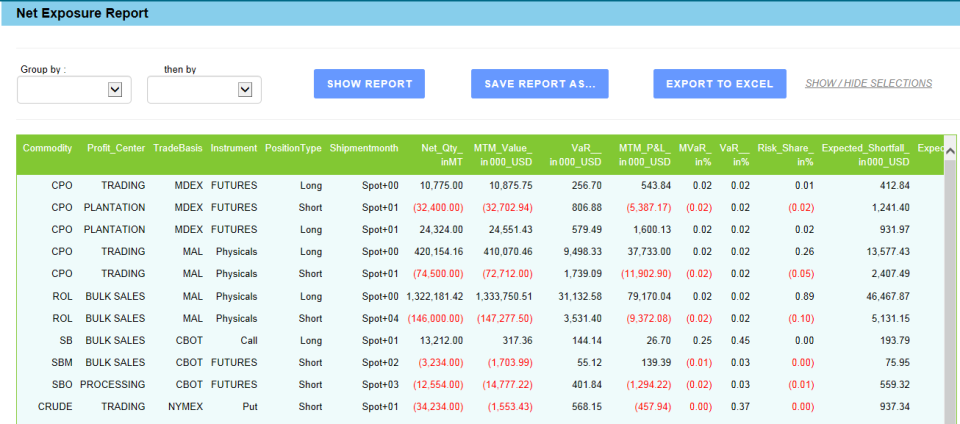

Enhanced Reporting Capabilities

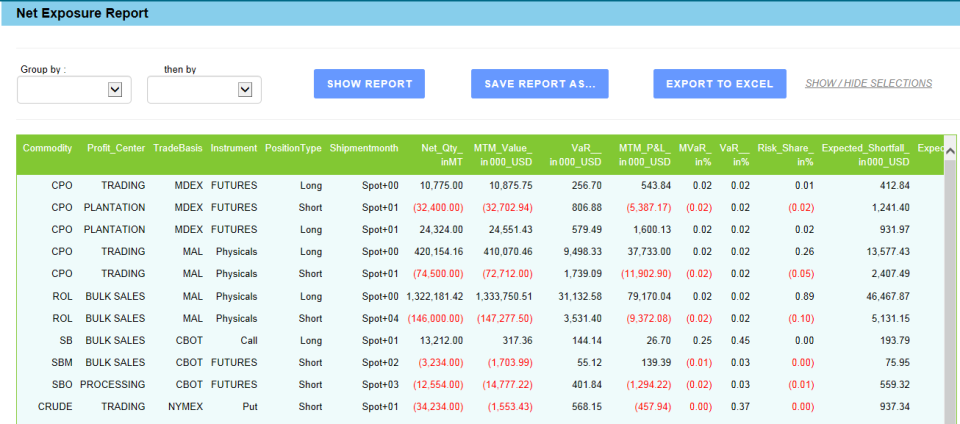

RiskEdge offers extensive reporting tools that allow professionals to share insights and reports with stakeholders efficiently.

- Custom Reports: Generate detailed reports tailored to your organisation's needs.

- Visual Analytics: Use strong visuals to represent complex risk data effectively.

- Automated Report Generation: Save time with automated report production for regular updates.

RiskEdge - RiskEdge-screenshot-0

RiskEdge - RiskEdge-screenshot-0  RiskEdge - RiskEdge-screenshot-1

RiskEdge - RiskEdge-screenshot-1  RiskEdge - RiskEdge-screenshot-2

RiskEdge - RiskEdge-screenshot-2  RiskEdge - RiskEdge-screenshot-3

RiskEdge - RiskEdge-screenshot-3  RiskEdge - RiskEdge-screenshot-4

RiskEdge - RiskEdge-screenshot-4

RiskEdge: its rates

standard

Rate

On demand

Clients alternatives to RiskEdge

Automate debt collection with ease using this software. Track and manage debts, automate reminders, and improve cash flow.

See more details See less details

With this debt collection software, you can easily manage all your outstanding debts from a single platform. Set up automated reminders and track payment history to improve your cash flow. The software also provides real-time analytics and reporting to help you make informed decisions.

Read our analysis about Hoopiz Credit ManagementBenefits of Hoopiz Credit Management

Coverage of the entire sales-to-cash chain

Modular: Recovery, credit insurance,...

Ease of use and speed of installation

Streamline your financial operations with cloud-based accounting software that automates processes and provides real-time insights.

See more details See less details

Our software offers a centralized platform for managing financial data, automating tasks such as invoicing and expense tracking, and generating reports to help you make informed decisions. With advanced security features, you can trust that your data is safe and accessible from anywhere.

Read our analysis about Oracle Cloud Financials

Automate financial risk management with ease. Monitor, analyze and mitigate risks efficiently.

See more details See less details

PlanEASe's software streamlines risk management by automating the process. With PlanEASe, users can quickly monitor, analyze and mitigate financial risks. The software provides an intuitive interface that allows users to easily identify potential risks and take proactive measures to address them.

Read our analysis about planEASe Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.