Simility : Advanced Fraud Prevention Solutions for Enterprises

Simility: in summary

What are the main features of Simility?

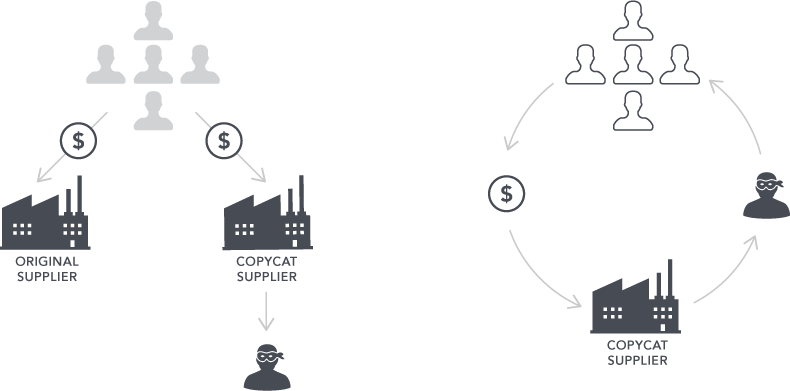

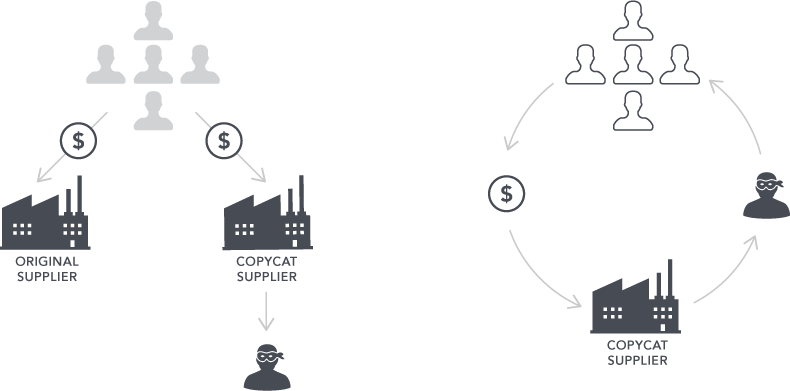

Advanced Machine Learning

Simility uses adaptive, advanced machine learning to provide superior fraud detection capabilities. Its algorithms learn and evolve continuously, keeping your defences strong against emerging threats. Key features include:

- Dynamic behaviour profiling for real-time threat detection

- Pattern recognition to anticipate potential fraud activities

- Self-learning models that adapt to new fraudulent patterns

Real-Time Data Analysis

Simility's real-time data analysis equips enterprises with rapid insights, enabling swift actions against fraud attempts. By processing vast amounts of data instantly, Simility ensures timely detection and response. Benefits include:

- Instantaneous risk assessment to preempt fraud

- Comprehensive data analytics for detailed fraud insights

- Integration with existing systems for seamless operations

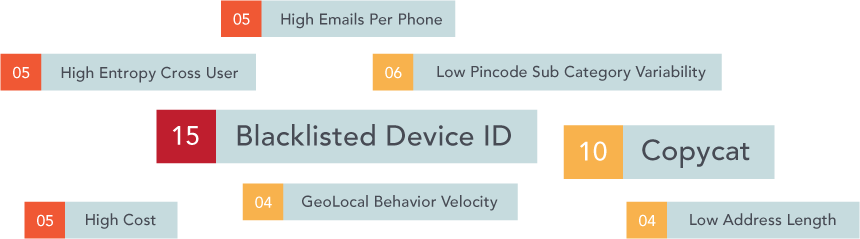

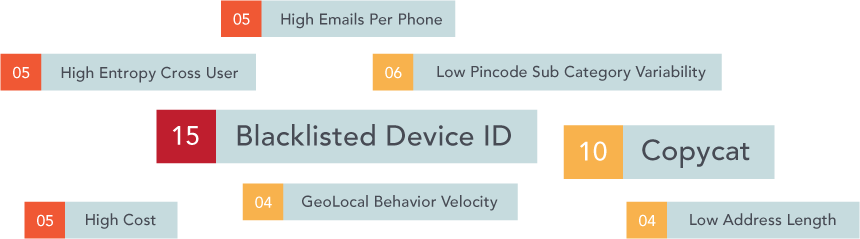

Customisable Rule Engine

Simility features a customisable rule engine that allows businesses to tailor their fraud protection strategies. Craft precise rules to identify and mitigate specific fraud scenarios, enhancing your security without compromise. Highlights are:

- User-friendly interface for straightforward rule configuration

- Flexibility to adapt rules as business needs change

- Ability to simulate scenarios to test rule effectiveness

Simility - Simility-screenshot-0

Simility - Simility-screenshot-0  Simility - Simility-screenshot-1

Simility - Simility-screenshot-1  Simility - Simility-screenshot-2

Simility - Simility-screenshot-2  Simility - Simility-screenshot-3

Simility - Simility-screenshot-3  Simility - Simility-screenshot-4

Simility - Simility-screenshot-4

Simility: its rates

standard

Rate

On demand

Clients alternatives to Simility

Prevent financial fraud with advanced detection software. Real-time analysis identifies anomalies and potential threats, reducing the risk of losses.

See more details See less details

iPrevent's sophisticated algorithms utilise machine learning to adapt to new threats and reduce false positives. Customisable alerts allow for tailored risk management.

Read our analysis about iPrevent

Detect and prevent financial fraud with advanced software that uses big data analytics and machine learning algorithms.

See more details See less details

Our software analyses vast amounts of data from multiple sources to identify fraudulent activities and transactions, providing real-time alerts to prevent losses. With user-friendly dashboards, customisable rules and API integration, it's easy to integrate into your existing systems and start protecting your business today.

Read our analysis about pipl

Powerful financial fraud detection software with advanced analytics and reporting capabilities.

See more details See less details

SAS Financial Management helps businesses detect and prevent financial fraud with its advanced analytics and reporting features. It provides a comprehensive view of financial data, identifies potential fraud patterns, and enables users to take proactive measures to mitigate risks.

Read our analysis about SAS Financial Management Appvizer Community Reviews (0) The reviews left on Appvizer are verified by our team to ensure the authenticity of their submitters.

Write a review No reviews, be the first to submit yours.